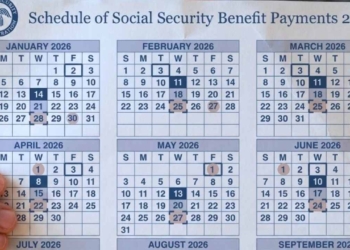

Not all American seniors qualify for Social Security payments in the United States. Among those who qualify, they may not get the full amount the Administration has set for 2025. What is more, there are four different paydays per month, so they may have already received from the Agency their monthly payment.

This monthly payment could come in the form of a direct deposit or a paper check. As for the amount, it will depend on the worker and their background. Bear in mind that each Social Security payment is made to measure. The Administration will pay more money to those who have paid more taxes as they worked, to those who worked for a minimum of 35 years, and to those who delay retirement until they are 70 at the same time.

Who is eligible for the Social Security payment on April 23?

Regardless of the amount of your retirement benefit payment on April 23, there are some key conditions for the last payday this month. To get money on this payday, retirees must have been born on a certain day.

For example, if you were born from the 1st to the 20th, you are not eligible. However, if you were born after the 20th, that is, from the 21st to the 31st, you will be eligible for the April 23 payment as long as you:

- filed and received approval from Social Security after April 30, 1997

- are not a recipient of the Supplemental Security Income

- did not break SSA rules and remain eligible

Who can receive the maximum Social Security payment on April 23?

The maximum Social Security payments on April 23 will only be for those high earners who filed at the age of 70, worked for 35 years in jobs covered by SSA and earned the contribution and benefit base for all those years.

Therefore, there is a very limited number of American workers who can receive so much money from the Administration. In fact, average payments tend to be much more frequent.

A retiree can get about $1,931 as of February 2025. Hence, there is a considerable difference between those seniors who get $5,108 and those who get average payments worth $1,931.

Some high earners who filed at the age of 62 will receive less money than those who filed at the age of 70. At 62, retirees can receive up to $2,831. Those high earners who filed at Full Retirement Age can get a lot more. Actually, their monthly payment could be up to $4,018.

So, it implies early filing reduces your Social Security payment, and late filing gives you additional money. So, SSA rewards those seniors who delay and wait to get direct deposits or checks until they are 70 years old. Do not forget that those retirees with a really low payment may get SSI too.