The official rollout of the 2026 Cost of Living Adjustment (COLA), fixed at 2.8%, is now active within the U.S. Social Security framework. This determination, finalized by the Social Security Administration (SSA) last fall, reshapes the benefit landscape for the nation’s vast network of retirees, survivors, and disability beneficiaries.

The calculation, derived from Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) figures recorded in the third quarter of 2025, directly influences the monthly payments for over 71 million Americans.

The disbursement logistics for January present a distinctive blueprint, carefully calibrated around calendar intricacies, most notably resulting in no standard January payment for those enrolled in the Supplemental Security Income (SSI) program.

The Social Security Payments Bring 2.8% Extra Money

The confirmed 2.8% upward adjustment governs payments for Social Security retirement, survivor, and disability (SSDI) benefits, alongside the federal component of SSI. Agency data indicates the average monthly benefit for a retired worker on an individual basis will climb from roughly $2,015 to an estimated $2,071.

This translates to an average net monthly increase of $56 dollars. It is imperative to note this sum represents a statistical mean; the precise figure deposited into any individual’s account hinges entirely on personal earnings history and the specific age at which benefit collection was initiated. External estimations cannot supersede the formal, individualized notice disseminated by the SSA.

More Changes in January: What About the SSI Payments?

Regarding the SSI program, the updated maximum federal payment standards, which do not incorporate potential state-level supplements, are now established at $994 monthly for an individual, while it goes up to $1,491 for an eligible couple, and the third maximum is the $494 for an “essential person”.

The “essential person” classification applies to certain individuals who reside with and provide care for an SSI beneficiary. These published amounts remain subject to reduction based on a recipient’s other countable income and available resources.

January’s Disbursement Timetable: Dual Tracks

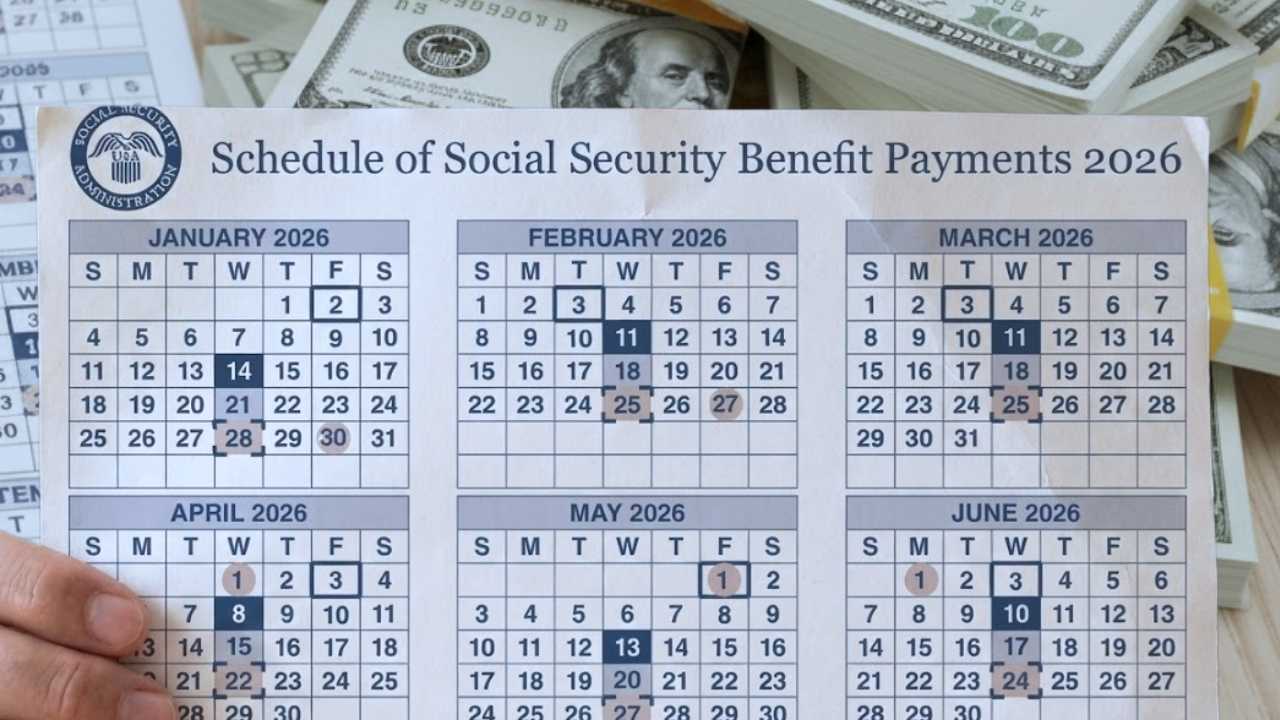

Fund distribution for the month operates on two separate, clearly delineated schedules, a long-standing practice designed to circumvent conflicts with weekends and federal holidays.

For beneficiaries of traditional Social Security (retirement, survivors, SSDI), the deposit sequence for January 2026 is as follows:

- Friday, January 2, 2026: This payment services the cohort accustomed to receiving funds on the 3rd of each month. This group largely consists of individuals who started receiving benefits prior to May 1997, plus those who receive concurrent Social Security and SSI payments. The deposit is advanced from Saturday, January 3rd, as that date falls on a non-business banking day.

- Wednesday, January 14, 2026: This constitutes the first monthly payment under the birth-date-dependent schedule. It encompasses all beneficiaries with birthdays falling between the 1st and the 10th of any given month.

- Wednesday, January 21, 2026: This represents the second payment cycle under the birth-date framework, covering those born between the 11th and the 20th of the month.

- Wednesday, January 28, 2026: This is the third and final scheduled payment for the month under this system, designated for individuals born between the 21st and the 31st of any month.

The SSI Beneficiaries Have Two Dates Changed in 2026

The schedule for SSI recipients follows a different pattern, a nuance that warrants careful attention to prevent misunderstanding. Because January 1, 2026, is observed as the federal New Year’s Day holiday, the SSA’s protocol mandated advancing the January payment to the preceding business day: Wednesday, December 31, 2025.

Therefore, SSI beneficiaries should have already obtained their January entitlement, inclusive of the 2.8 percent COLA, during the final week of 2025. No payment labeled for January 2026 will be issued during the month itself.

However, the SSA will process an SSI-related payment in January. This disbursement is actually the February 2026 benefit, which is itself being moved forward because February 1 falls on a Sunday. Recipients can expect this particular deposit to arrive on Friday, January 30, 2026.