A familiar sense of anticipation settles over households across the country each month as retirees, survivors, and disabled citizens await their Social Security benefits. For January 2026, that wait comes with a modest but meaningful increase, the result of the annual Cost-of-Living Adjustment, or COLA.

This year’s increase of 2.8%, confirmed by the Social Security Administration (SSA), is more than a statistic on a government press release; it’s a financial lifeline for nearly 71 million beneficiaries trying to keep pace with the costs of groceries, prescriptions, and utilities.

Who Do the Social Security Benefits Come With an Extra 2.8%?

This adjustment, calculated based on the rise of the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the third quarter of 2024 to the third quarter of 2025, is a built-in promise of the Social Security program, designed to prevent benefits from eroding over time.

The timing of this increase is, actually, a well, conceived idea. The boosted payments begin with the checks that arrive in January 2026 and the amounts will be valid up to the month of December of the same year.

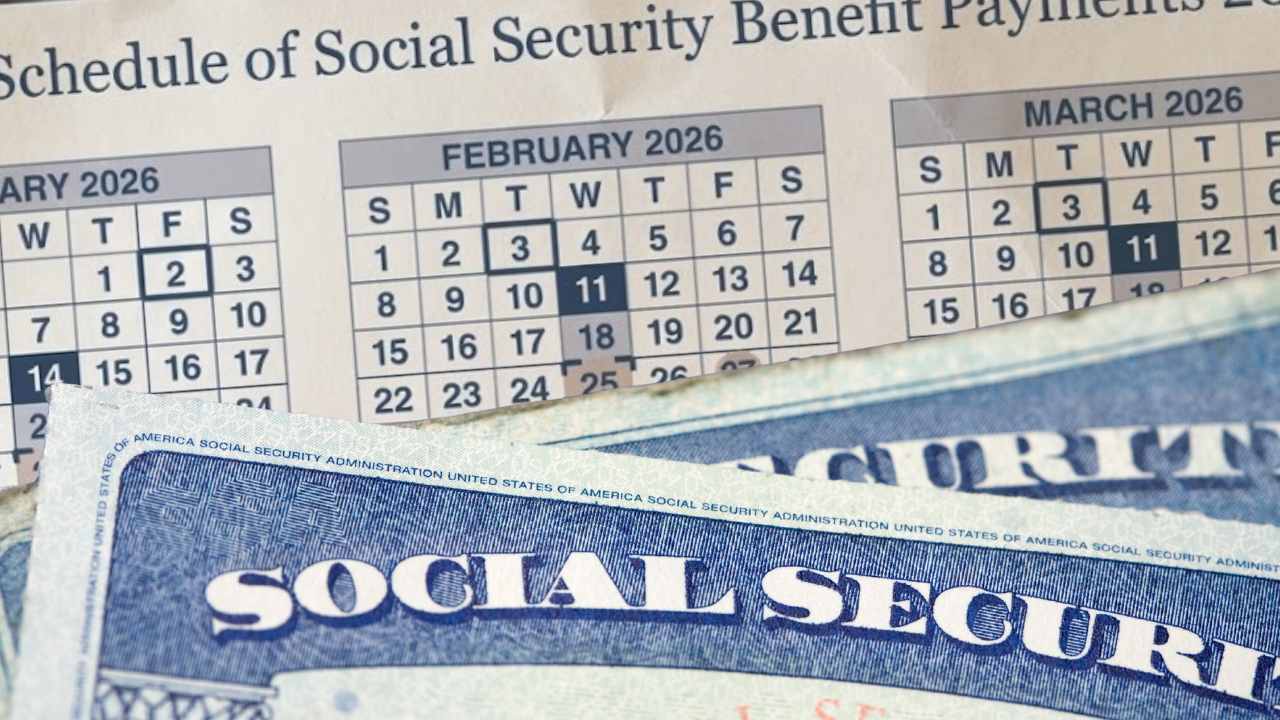

January Payment Dates Confirmed by the SSA

However, the rhythm of these arrivals follows a familiar monthly pattern dictated by a recipient’s birthdate. For those receiving Social Security retirement, survivors, or disability insurance benefits—and who started claiming after May 1997—the payment schedule for January is locked in.

If your birthday falls between the 1st and the 10th of any month, your payment will be deposited on the second Wednesday of January, which is the 14th. Those born between the 11th and the 20th can expect funds on the third Wednesday, January 21st. Anyone with a birthday from the 21st through the 31st receives their payment on the fourth Wednesday of the month, January 28th.

It’s a different calendar for the nearly 7.5 million recipients of Supplemental Security Income, the program that aids aged, blind, and disabled people with little to no income. Their increase actually kicks in earlier, with the payment already issued on December 31, 2025. For them, the new maximum federal payment rates are now $994 per month for an eligible individual and $1,491 for an eligible couple.

Changes Over Social Security Taking Place from January

Beyond the headline COLA figure, other key thresholds are also shifting upward for 2026, reflecting changes in national wage levels. For workers who continue to earn a paycheck while receiving benefits and are below their full retirement age, the earnings limit is rising to $24,480 per year.

The SSA will deduct $1 from benefits for every $2 earned above that limit. Perhaps more significantly, the maximum amount of earnings subject to the Social Security payroll tax is jumping substantially, from $176,100 to $184,500.

Social Security Commissioner Frank J. Bisignano framed this year’s adjustment as part of the program’s core mission. “Social Security is a promise kept, and the annual COLA is one way we are working to make sure benefits reflect today’s economic realities and continue to provide a foundation of security,” he stated upon the announcement last October.