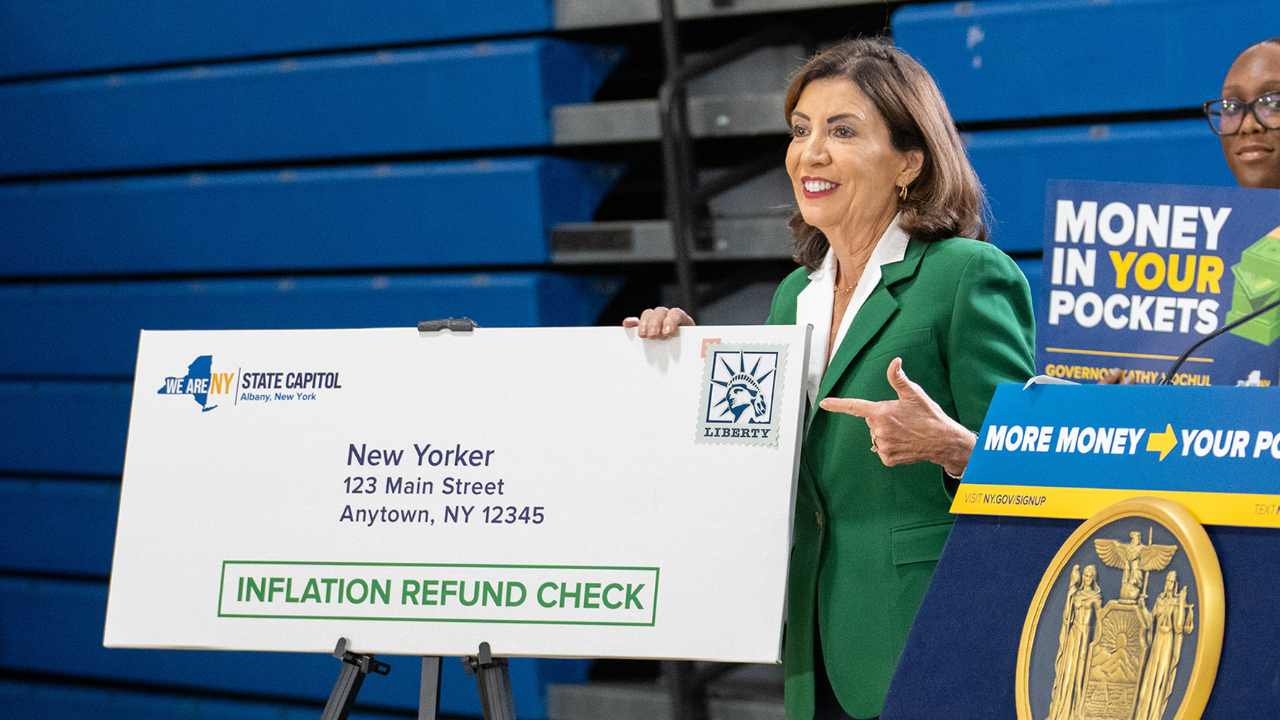

The State of New York is moving ahead to send out more inflation refund stimulus checks, a one-time payment approved in the state budget that aim to help residents cope with the rising cost of living (hence the name).

As thousands of taxpayers begin finding these stimulus checks in their mailboxes, interest is growing in understanding who qualifies, how much money they are entitled to, and the reasoning behind this initiative that has generated widespread interest across the state.

What’s the origin of this stimulus checks program?

The program originated within the state budget for fiscal year 2025-26, where legislators and the governor agreed on an exceptional measure to return some of the tax burden accumulated by New Yorkers during a period marked by persistent inflation.

Unlike other programs, these payments do not require registration: the state Department of Taxation and Finance is automatically issuing checks to all eligible individuals, using data from 2023 tax returns.

These people qualify for the inflation refund checks

Eligibility is directly tied to 2023 tax compliance. To receive the payment, the taxpayer must have filed a state tax return as a full-time New York resident. Additionally, they cannot have been claimed as a dependent on someone else’s return—a significant filter that excludes many college students and young adults still listed on their parents’ returns.

Another key factor is the level of reported income, specifically adjusted gross income (AGI) index. Although the thresholds vary depending on filing status, the structure is progressive: those who earn less receive higher amounts. For example, single taxpayers with an AGI up to $75,000 tend to receive around $200. Those with higher incomes—up to approximately $150,000—receive a reduced amount, around $150.

Couples filing jointly receive larger amounts. A married couple with an AGI of $150,000 or less can receive approximately $400, while those with an income up to $300,000 generate a payment of around $300.

How are the checks actually calculated

The payments are designed as a partial refund of taxes paid in an inflationary environment. They do not constitute a traditional tax credit, nor an advance on future refunds. Essentially, it is a standalone payment calculated based on income level and tax status declared in 2023.

The one-time nature of the payment is important: it is not a monthly or recurring program, and it’s not expected (to this day) that these checks will be repeated in the upcoming years.

Shipping process and estimated times

The Department of Taxation and Finance began sending checks in late September 2025. The process is not simultaneous for all recipients; the checks are being issued in stages and will continue for several weeks in the fall.

Checks are sent to the mailing address listed on the taxpayer’s most recent state tax return. This has caused some delays for those who have moved and haven’t updated their information with the state. Authorities recommend verifying the address on the Department of Revenue’s online system if you are concerned about a check not being received.

Some checks will still be on their way in December 2025 for hundreds of million of households all over the state.

The checks are fresh air for New Yorkers

The distribution of these payments comes at a time when the national economy is showing mixed signs. While inflation has slowed from its peak, food, rent, and utility prices remain high compared to pre-pandemic levels. In cities like New York, where the cost of living exceeds the national average, even moderate price fluctuations have a significant impact on households.

Fiscal policy groups have reacted to the measure with mixed opinions. Some argue that the one-off payments are insufficient to offset the accumulated loss of purchasing power, while others emphasize that it is a necessary and timely relief, especially for low- and middle-income families.

What to do if the check doesn’t arrive

Authorities indicate that taxpayers who do not receive their payment by the end of the distribution period can check the status of their payment through the official website of the Department of Taxation and Finance. In cases of loss or incorrect delivery, reissue requests will be available, although this process could take several additional weeks.