The state of Georgia is closing out the year with a gesture that will resonate in the pockets of millions of its taxpayers: the return of more than one billion dollars in budget surpluses. These tax refunds are part of the Surplus Refund Program, a tangible reality whose checks and direct deposits have already begun to circulate.

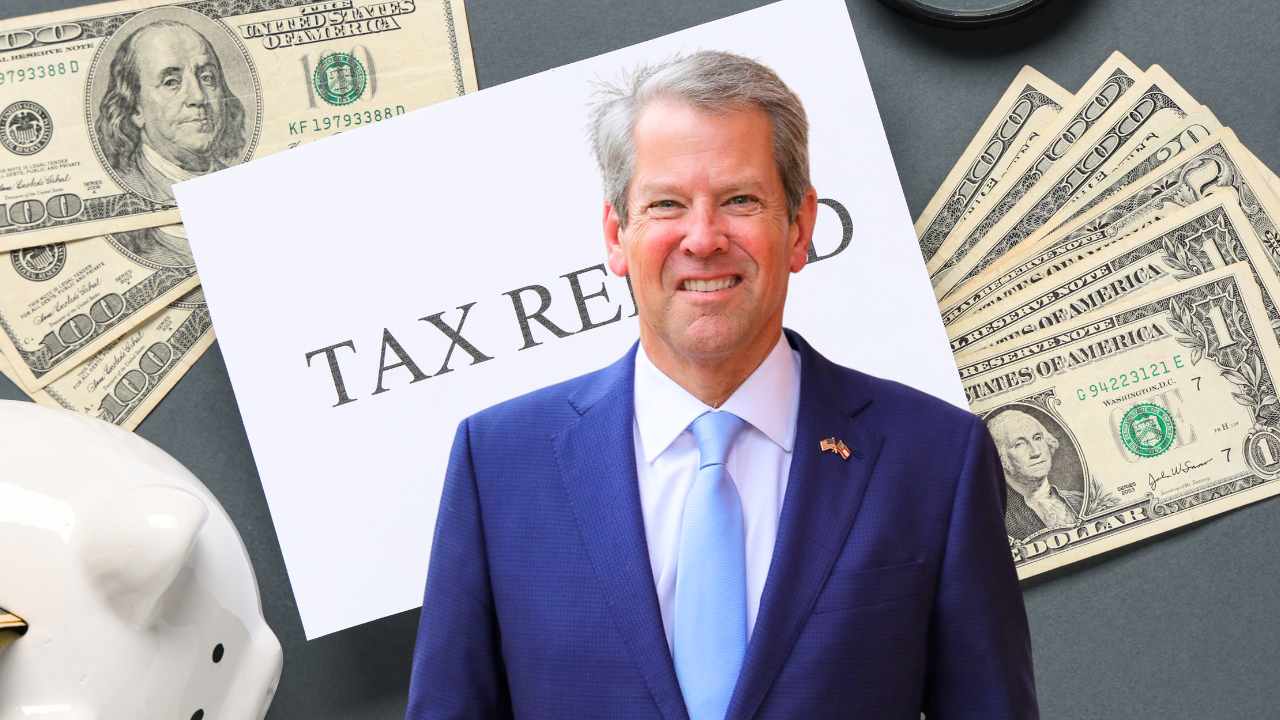

Under Governor Brian Kemp’s administration, this initiative, the third of its kind, has become a trademark of an economic philosophy that prefers to return money to its rightful owners rather than swell the state machinery: this is how tax refund checks of up to $500 were set up for eligible Georgians.

The story behind this massive tax refunds program

Sales and corporate tax revenues, fueled by stronger-than-expected economic growth, have filled the state coffers to overflowing. This surplus, managed with fiscal conservatism that nods to Republican orthodoxy, found its outlet in House Bill 112 (HB 112).

Signed by Kemp on April 17, this legislation is not a mere bureaucratic formality; it is the legal framework that allows for direct capital injections into the domestic economy. The law amends the Georgia Official Code to authorize a one-time, direct rebate, funded exclusively with state funds, without a single penny of federal money involved. It is, in essence, a return of surplus funds, not a structural cut.

Checks in Georgia go d$250 to $500 per Household

The amount eligible taxpayers receive is not a uniform figure, but rather fluctuates according to their 2023 tax return. To be precise, the refund acts as a reflection of what each person paid in state income tax that year, with a set maximum limit.

Thus, single people or married people filing separately can receive up to $250. Heads of household, often with heavier financial burdens, see that ceiling raised to $375. And couples filing jointly, the quintessential family unit, can aspire to a maximum of $500.

How tax refunds reach Georgians

The process for receiving your refund is as simple as it is familiar to any taxpayer: direct deposit for those who indicated it on their return, or a physical check for everyone else. There are no tricks, no promotional debit cards, and no fine print.

And if the good news weren’t enough, these refunds are tax-exempt at both the state and federal levels. The money arrives clean, without the shadow of a future tax liability.

Who is eligible to receive the checks

But not all Georgia residents are receiving this windfall. Eligibility is a strict filter. To qualify, one had to have filed a state income tax return for the 2023 fiscal year (Form 500 or 500EZ) and, crucially, actually paid state taxes on it.

Those who did not have a balance due or whose withholdings did not generate a standard refund are excluded. Timeliness was another key condition: the return had to be filed before May 1, 2025. Time extensions, on their own, were not an automatic guarantee of a refund.

It is estimated that between four and five million taxpayers have passed these filters, with a tacit focus on low and middle income households, those who felt the weight of taxes the most and for whom a few hundred dollars can mean the difference between making ends meet or not.

Fresh payments scheduled to come

The distribution process, a massive logistical operation managed by the Georgia Department of Revenue (DOR), began the week of June 2nd. However, for a small group—those with applications due right at the deadline, pending verifications, or outdated addresses—the wait could extend into December. The state hasn’t set a final cutoff date, but the unspoken message is clear: the train is approaching its last stop.

The Department of Revenue has enabled a beacon of clarity: the “Surplus Tax Refund Eligibility Tool” at the Georgia Tax Center (gtc.dor.ga.gov) by simply entering their Social Security number (or ITIN) and their 2023 Federal Adjusted Gross Income, any citizen can find out in seconds if they are eligible and what the status of their payment is.