In the midst of the most anticipated tax season of the year, millions of Americans are dreaming of a generous refund to help them cope with the rising cost of living in 2026. The Internal Revenue Service (IRS) anticipates receiving around 164 million individual tax returns for the 2025 tax year, and most taxpayers are crossing their fingers for a hefty check.

But here’s the part few want to hear: if that refund arrives unusually large, it could be a sign that you’ve been overpaying the government all year long; it’s almost as if you’ve given the federal agency (ergo, the federal government) an interest-free loan.

Why a Massive Tax Refund in 2026 Is Actually Bad News for Your Wallet

Tax experts say it time and again: a large refund isn’t always a blessing. It’s actually money you could have had in your pocket month after month to cover rent, gas, or that unexpected bill. And this year, with recent changes to tax rules, the risk of overpaying is even greater, especially for homeowners.

According to official IRS data, the filing season began on January 26 and runs until April 15. But what’s really making waves are the changes introduced by the law known as “One Big Beautiful Bill Act,” passed in July 2025, which brought retroactive cuts and adjustments that many still haven’t fully digested.

Here’s the scenario we’re dealing with this year: during 2025, the IRS didn’t update its tax withholding tables in time to reflect these benefits. That means that, for millions of workers, more than they should have been deducted from each paycheck.

The New SALT Cap Could Mean You’re Overpaying the IRS

The result was that the average refunds could be up to $1,000 higher than in previous years. For homeowners, the impact is particularly noticeable. The cap on the deduction for state and local taxes—that famous SALT—jumped from $10,000 to $40,000.

Suddenly, your mortgage interest, property taxes, and even energy-efficient home improvements weigh much more heavily against your taxable income. In high-tax states like California or New York, this can translate into real savings of thousands of dollars.

But if your W-4 form is still the same as it was two years ago, those savings will be stuck in the government’s coffers until April.

Think about the average family that just bought their first home: they’re paying a hefty mortgage, taxes that rise with the property’s value, and maybe they’ve invested in solar panels to lower their electricity bill. All of that generates credits and deductions that reduce the final amount due.

Alert for Homeowners: Stop Giving the IRS a Free Loan

But here’s the good news: avoiding this doesn’t require magic or a finance degree. It simply requires taking control right now. The first step is to access the IRS withholding calculator, that free tool on their website that asks for your salary, deductions, and family situation.

In 15 minutes, it tells you exactly how much to adjust on your W-4. Then, just fill out the new form and submit it to HR. You can do this several times a year, whenever something changes: a raise, a new child, or simply because you realize you’re withholding too much.

For homeowners, the trick is to include everything: your bank’s Form 1098 with your mortgage interest, property tax receipts, and even energy efficiency expenses. If your situation is a bit more complex—two jobs, rental income, or investments—consider scheduling an appointment with a certified tax preparer. It’s worth every penny, especially this year, with new forms like Schedule 1-A for claiming deductions for tips, overtime, or interest on a new car.

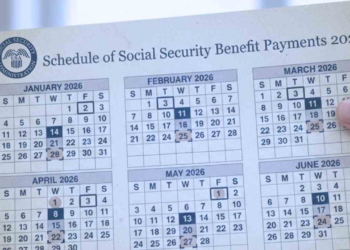

And let’s not forget the changes in how the IRS delivers money. Forget paper checks because since September of last year, almost everything is done by direct deposit. If you don’t update your bank information on your return, your refund will be frozen until you fix it. It’s a hassle that many will discover too late, but it’s easily avoided by checking the correct box when filing.