In his office in Washington, D.C., Senator Josh Hawley says he understands that American families are facing increasing tax pressures. But he has a proposal on the table to address that issue: the American Worker Rebate Act of 2025. It’s not just another bill with a file number (S. 2475) and tax jargon, but it could also generate new stimulus checks, which we all crave.

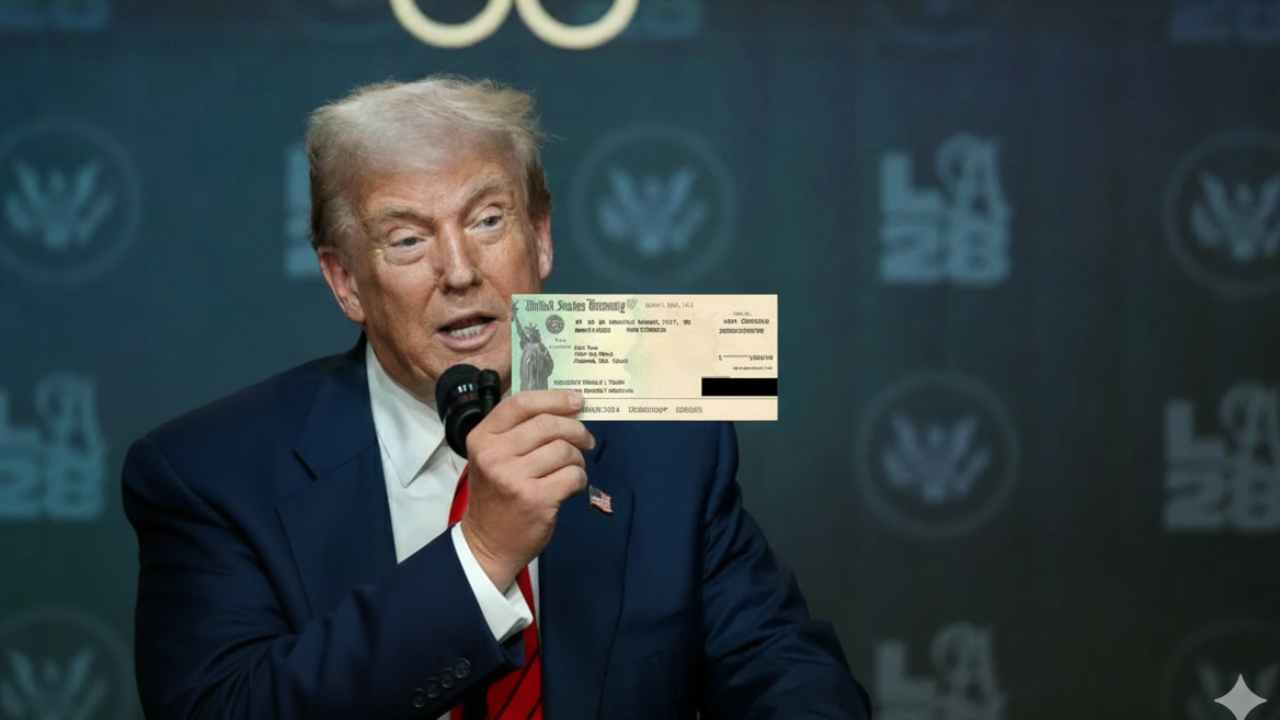

For millions of working-class households, it’s a tangible promise, a potential lifeline thrown into a sea of economic uncertainty. The law is the legislative reflection of an idea President Donald Trump has been promoting using the money raised from tariffs on foreign imports.

So, the government would put cash directly into the pockets of American workers in the form of stimulus checks, which, if approved, would be sent out within months.

American Worker Rebate Act of 2025: Stimulus Checks in the Making

The mechanism is simple in its objective, although complex in its execution. All revenue collected by the federal Treasury from tariffs imposed since January 20, 2025, would be allocated to a fund to finance “refunds.” It is not a debt-financed stimulus, its proponents argue, but rather a redistribution of wealth coming from abroad.

The heart of the proposal is a figure: at least $600 per adult and $600 for each dependent child. For a family of four, like the average American family, that would be $2,400.

Who would be eligible for these stimulus payments?

But the law has nuances. The payments are not universal. They phase out gradually for those with adjusted gross incomes above $75,000 if single, or $150,000 if married filing jointly. It is designed to prioritize working-class and middle- and low-income families.

Furthermore, the bill includes a very interesting clause: this money could not be seized by the government to pay outstanding tax debts or federal loans. By law, it would go entirely to the family.

The big question floating in the air, in kitchens, at gas stations, in workshops, is the same:

And if it is approved, when will the money arrive?

Here, hope collides with the cold mechanics of Washington. The bill is currently in the Senate Finance Committee. It has no public co-sponsors yet. Its future depends on a maze of hearings, amendments, votes, and potential filibusters. Senator Hawley has expressed his desire for the checks to be distributed “this year,” but that’s an aspiration, not a guarantee.

If it moves forward, the process will resemble that of the pandemic stimulus checks. The IRS would use 2024 tax returns (or 2023 if the most recent returns are unavailable) to calculate and send the payments “as quickly as possible.” Electronic payments would arrive first, to bank accounts the IRS has on file. Physical checks would then follow in the mail.

In the best-case scenario, the first payments could begin in late 2025 or very early 2026. But every day of debate in Congress is a day working families wait.