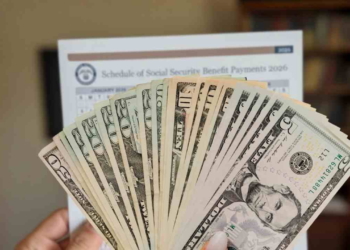

By December 2025, a large number of U.S. states began distributing tax refunds, rebates, or relief payments. These disbursements are commonly linked to state budget surpluses, inflation relief initiatives, or specific programs such as property tax credits.

They are generally one-time or ongoing payments, separate from regular income tax refunds, which are typically processed earlier in the fiscal year.

Not all state tax administrations process every eligible application immediately. Payment deadlines may extend into early 2026 for taxpayers who filed close to the deadline or whose cases require further verification.

States Sending Tax Refunds and Reliefs in December

In Alaska, the Permanent Fund payment is an annual distribution of state revenue. The amounts, which will be $1,000 this year, are distributed in installments, with the final disbursement scheduled around December 18 for outstanding or late applications.

Meanwhile, California is running an additional round of its Middle Class Tax Rebate, with payments of up to $1,050 for those who filed their 2023 tax return and meet certain income thresholds.

Colorado’s, Georgia’s, and Florida’s Tax Refund

Colorado distributes its Taxpayer Bill of Rights (TABOR) refund throughout December on a rolling schedule. Full-time residents who filed their 2024 return may receive up to $1,500.

In Florida, a Property Tax Refund targeting areas affected by natural disasters offers up to $1,200 to residents of specific counties who meet income criteria, with payments expected by the end of the month.

Georgia is finalizing its Excess Tax Refund payments in December, which provide between $250 and $500 to individual taxpayers with incomes below $75,000.

Illinois, Indiana, Maine and Other States

Illinois continues distributing its Family Relief Payments, which range from $100 to $400 depending on household size, to those who filed their 2024 tax return. In Indiana, the $125 Individual Taxpayer Relief Refund continues its distribution from November through December.

Maine distributes its Family Home Exemption Refund throughout the month, up to $1,700 for homeowners who filed a 2024 return. Massachusetts schedules the remaining payments of its Chapter 62F Excess Refund for December, a variable percentage of the 2021 tax liability. Michigan makes the continuing distributions of its expanded Working Families Tax Credit in December, averaging $550.

Let’s Wrap It Up: Finald Checks of 2026

Minnesota concludes its Inflation Relief Deposits in December, with typical amounts between $200 and $500 for eligible taxpayers from previous returns. New Jersey processes the remaining batches of its ANCHOR property relief program in early to mid-December, with payments of $400 to $1,500 for income-qualifying homeowners and renters. New York extends the payment deadline for its Inflation Rebate and Property Tax Credit until the end of the year.

Oregon automatically applies its “Kicker” Credit to refunds processed in December as a refund for over-collection. Finally, Virginia completes its One-Time Tax Refund payment in December, up to $200 for individuals and $400 for joint returns, for those who had a tax liability in 2024. It should be noted that exceptionally high processing volumes or verification issues could delay some marginal payments until January 2026.