American taxpayers who are thinking about selling their car may be wondering whether they must pay taxes to the IRS or not. No doubt, everyone wants to avoid tax issues when they receive earnings, whether they are from work or not. If you sell your car, make sure you know what the Internal Revenue Service says about this topic.

As a matter of fact, it is mandatory to report to the IRS any capital gains you have had from the sale of your car. Since the sale of your car may provide you with capital gains, it is necessary to do so when this happens. Capital gains are when you sell your car for a higher price than you paid for it when you bought it in the past. Thus, the difference between the sale price and the original cost of the car is what we call capital gains.

IRS tax obligations when you sell your car

When it comes to the sale of a car, tax obligation refers to the sellers’ obligation to inform the government about any capital gains they may have had. Thus, make sure you follow the IRS guidelines when it comes to this topic. The amount you must pay will depend on several factors, your taxable income, the tax bracket, and when you bought the car.

Sometimes you may sell your car, but you are not able to sell it for an amount that generates capital gains for you. Therefore, you are just recovering part of the cost of the car you have just sold.

If you are not sure about it, it is always advisable to contact the IRS, and they will be able to help you find out if you have to pay taxes or not for the sale of your vehicle.

Some taxpayers hire a tax professional, so they can also inform them about the cost of the car when they bought it, and the final price of its sale. These two ways will allow you to avoid any interest fees or penalties.

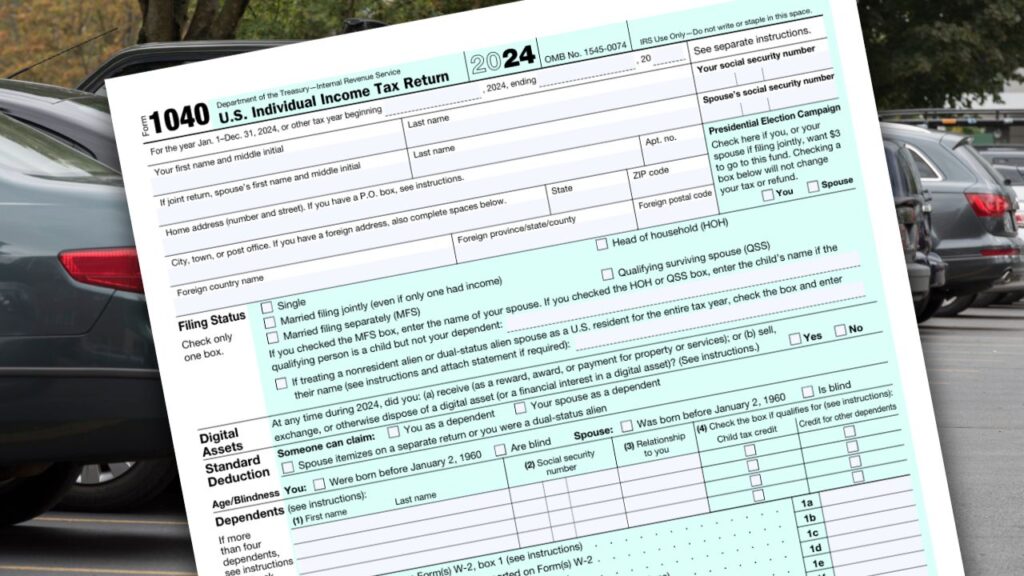

IRS forms to report that you sold a car at a gain

Although it is unlikely that you manage to sell your car for a higher price than it cost you, it is possible. For example, after a natural disaster, tens of thousands of cars can be destroyed, perhaps even more.

This could result in a higher demand for cars, which could lead to a price increase. In this case, you will need to make use of the Form 8949 and Schedule D (Form 1040).

- IRS Form 8949 – Sales and Other Dispositions of Capital Assets

- to reconcile amounts that were reported to you and the IRS on Form 1099-B or 1099-S (or substitute statement) with the amounts you report on your return.

- IRS Schedule D (Form 1040) – Capital Gains and Losses

- to be used when the sale or exchange of a capital asset is not reported on another form or schedule