Every month, recipients of Supplemental Security Income (SSI) rely on their payments to cover essential living expenses. However, December will bring a slight adjustment to the usual schedule, causing payments to arrive on an unusual date. While this may initially sound concerning, there’s no reason to worry—this change will not negatively impact beneficiaries’ finances.

Understanding these shifts in payment dates is crucial, especially for SSI beneficiaries who depend on these funds as the foundation of their financial stability. The adjustment is due to a calendar anomaly that moves December’s SSI payment to an earlier date in November, meaning recipients will see two payments in November instead of the usual one.

December SSI Payment moved to November: important details

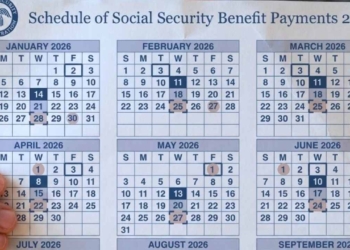

The Social Security Administration (SSA) has confirmed that the December SSI payment will not be made on its usual date. Instead, beneficiaries can expect their funds a bit earlier than anticipated. Here are the key points to keep in mind:

- New payment date: December’s SSI payment will be issued on Wednesday, November 29, because the usual payment date, December 1, falls on a Sunday.

- Double payment in November: SSI recipients will receive both November and December payments in the same month.

- Reason for the change: Payments are adjusted when the standard date lands on a weekend or federal holiday, ensuring funds arrive on the last business day before the scheduled date.

This shift affects only SSI recipients. Other Social Security beneficiaries, including retirees and individuals with disabilities, will receive their payments according to the regular calendar without any changes.

Who qualifies for Supplemental Security Income payments?

To qualify for the Supplemental Security Income program, applicants must meet strict eligibility requirements. Here is a breakdown of the key criteria:

Age and condition

- Must be at least 65 years old, or

- Be blind or living with a qualifying disability.

Residency

- Must reside in one of the 50 states, Washington, D.C., or the Northern Mariana Islands.

- Exceptions: Children of military personnel stationed abroad or certain students temporarily studying outside the U.S.

Citizenship

- Be a U.S. citizen, or

- Meet specific non-citizen eligibility conditions, such as:

- Meeting alien status requirements for benefits after August 22, 1996.

- Being a legal permanent resident or having lived in the U.S. permanently before the cutoff date.

Financial limits

- Income and resources must fall within established SSI thresholds.

Application process

- Submit a formal application to the Social Security Administration.

Spousal eligibility

- A spouse may qualify if they live in the same household, meet all eligibility criteria, and apply jointly as a couple.

This adjustment provides an excellent opportunity for SSI beneficiaries to plan ahead and make the most of their November payments. Being aware of these scheduling nuances can ensure seamless financial management without disruptions.