Several recent analyses and projections anticipate that federal tax refunds will show an average increase of nearly $1,000 when US taxpayers file their returns for the 2025 tax year, a process that will take place in 2026. This expectation is based on data compiled by various financial analysts.

The primary factor identified for this growth is the 2025 tax reform, formally known as the One Big Beautiful Bill Act (OBBBA). This legislation, passed in July of that year, establishes a series of tax changes with retroactive effect. Among the most significant provisions are the elimination of taxes on certain overtime and tip income, a temporary increase in the limit for state and local income tax deductions (SALT), and the maintenance of pre-existing tax cuts.

The OBBBA Act Is Changing Your Tax Refund: Extra $1,000 Could Happen

An additional factor contributing to this phenomenon is the situation of numerous taxpayers who failed to adjust their monthly withholdings. This lack of updates to their W-4 forms, attributed to either a lack of awareness or technical difficulties, resulted in a higher amount being deducted from their paychecks during the year than is now required. Consequently, when they settle their tax liability, the difference to be refunded is greater.

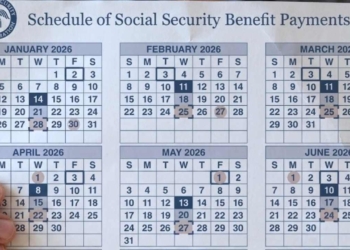

According to assessments by the firm Piper Sandler, the average payout would experience a significant increase, rising from approximately $3,151 in the previous season to around $4,151 in the 2026 cycle. This change represents a percentage increase of nearly 33% compared to historical values.

On the other hand, federal government estimates quantify the net tax relief generated by the package of measures at approximately $191 billion by 2026. Of the total projected, $91 billion is estimated to be increased refunds directly on tax returns. Another $30 billion would correspond to a reduction in withholdings applied to regular payments throughout the year.

Prepare for the 2026 Tax Season Now

The distribution of this benefit, however, is not expected to be uniform across all taxpayer groups. Available analyses indicate that middle- and upper-middle-income households, with incomes ranging from $60,000 to $400,000 annually, would be the primary recipients of the tax advantages.

In contrast, low-income taxpayers are projected to experience a substantially smaller or no impact. The magnitude of the benefit for this group depends on specific circumstances, such as their ability to use itemized deductions or the type of return they file, which may limit their access to the new incentives.

What Tax Changes Are Driving This Increase?

The anticipated increase in refunds is a direct result of several key changes to the tax code. One of these is the elimination of taxes on overtime and tip income. This measure particularly affects employees in sectors such as services, hospitality, and others where tips constitute a significant part of their compensation.

Another impactful change is the expansion of the SALT deduction, whose limit was raised from $10,000 to $40,000. This change most significantly benefits taxpayers residing in states with high state and local taxes, a profile that often coincides with upper-middle-income households that opt for itemized deductions on their tax returns.

Additionally, the law establishes the maintenance of reduced individual marginal rates, along with other deductions that were initially introduced in the 2017 tax reform. The permanence of these parameters contributes to an overall reduction in the tax obligation for a broad spectrum of the population.

Since the law was passed in mid-2025, but its application extends throughout the entire fiscal year, many taxpayers continued to be subject to the previous withholding tables for several months. This accumulation of overpayments is what will result in larger refunds in 2026.