Billions of dollars generated in auctions where large industries buy their right to pollute end up in the pockets of Californians every year. This is the California Climate Credit, a line item that appears automatically on the electricity and gas bills of most households and small businesses in the state.

In 2026, this program will celebrate its twelfth year operating as a unique mechanism in the United States: a direct credit designed to offset the cost of the energy transition on household budgets. However, its immediate future is subject to regulatory debates that could alter its distribution and amounts.

California Climate Tax Credit: Expect a Refund in your Utility Bills

The credit, administered by the California Public Utilities Commission (CPUC), is funded by revenue from the state’s cap-and-trade emissions program. The law mandates that a substantial portion of those funds—approximately 80%—be returned to consumers. It is not a consumption-based subsidy, but rather a fixed discount per account, regardless of energy usage.

The stated objective is twofold: to offset rate increases associated with climate policies and to incentivize, through savings, the reinvestment of the credit money in energy efficiency.

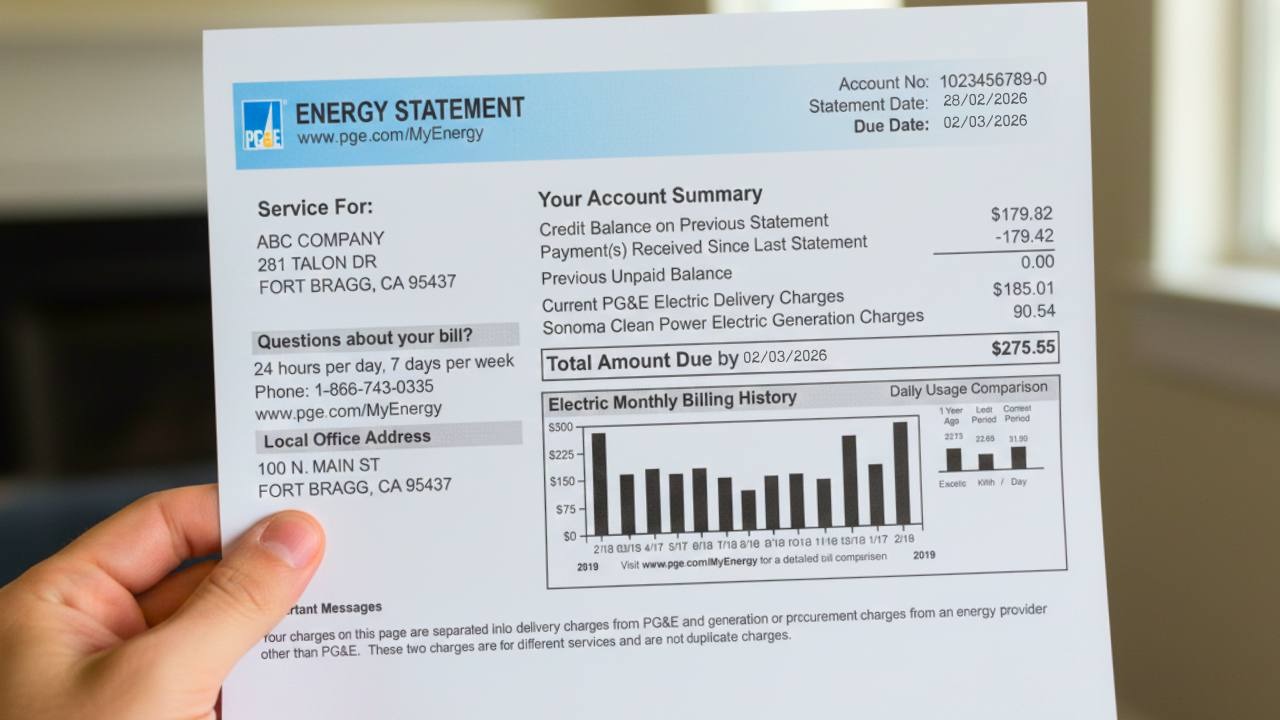

For the current year, the key distribution dates have already been set. Electricity customers of major companies (PG&E, SCE, among others) will receive the credit twice: in April and October.

Natural gas customers will receive it once, also in April. Exact dates may vary by a few days, depending on each utility’s billing cycle. Customers who do not see the credit on their bill for that month should check the following month’s bill, according to CPUC protocols.

Are There Amounts for the California Climate Credit?

As of the date of this report, the CPUC has not published the official figures. The last public update on its website corresponds to the 2025 credits. Sources within the commission, in statements collected during its public sessions last July, indicate that upward adjustments are being considered to improve “affordability,” in a context of persistent inflation and volatile energy prices. Historically, the amounts have shown variations.

In 2025, for example, the residential electricity credit per payment ranged from $34.91 from Bear Valley to $81.38 from SDG&E. For gas, SoCalGas offered the largest single discount: $86.60.

One relevant piece of information is the proposal, already approved for some smaller utilities like Pacific Power, for credits that would exceed $110 per electricity payment in 2026. This anticipates a possible upward trend. Furthermore, state budget announcements have indicated an allocation of up to $60 billion for the program through 2045, suggesting its continuation and potential strengthening.

Climate Tax Credits’ Eligibility Remains Broad

Any residential or small business customer (with peak demand below 20 kW) of a CPUC-regulated utility or Community Choice Agency (CCA) automatically qualifies. This includes households in low-income programs such as CARE, solar panel customers, electric vehicle owners, and renters.

Based on 2025 figures, it is estimated that more than 11.5 million residential accounts will benefit from the discount. Customers of municipal utilities such as LADWP or SMUD are not eligible, as they are not under CPUC jurisdiction.

The program is not without controversy and change. Currently, the CPUC is evaluating structural reforms following a July 2025 order to prioritize affordability. In the legislature, proposals such as AB729 have sought, so far unsuccessfully, to modify distribution dates and target credits solely to low-income populations or specific industries.