Imagine you’re about to blow out the candles on your 62nd birthday this year, dreaming of hanging up your gloves and starting to collect your full Social Security benefits. But there’s a detail many have overlooked, and it could completely change your perspective.

In 2026, the Full Retirement Age—that magical FRA everyone talks about—has finally reached 67 for anyone born in 1960 or later. This isn’t a new whim of Congress or a last-minute surprise. It’s been brewing since the 1983 law, when Ronald Reagan and his team decided to raise the retirement ages so the system wouldn’t collapse as people lived longer.

But now, in February 2026, the adjustment is official and complete. And yes, for many, it came as a shock.

Social Security’s Biggest Change in Decades Just Hit in 2026

Think about how it’s been gradually increasing:

-

The Full Retirement Age (FRA) has been gradually increasing over time.

-

For individuals born between 1943 and 1954, the FRA was exactly 66 years old.

-

The age then increased by two months per birth year:

-

66 and two months for those born in 1955.

-

66 and four months for those born in 1956.

-

This pattern continues until those born in 1959, who retire at 66 and ten months.

-

-

For anyone born in 1960 or later, the FRA is now fixed at 67 years old.

-

If you are turning 62 in 2026 (born in 1964), your FRA will be in 2031.

-

Claiming benefits early at age 62 results in a permanent 30% reduction:

-

For example, a full benefit of $1,000 per month would be reduced to just $700.

-

Max Social Security Checks Just Hit $5,181

Because yes, the impact is real. If you wait until 70, the reward is substantial: it increases by 8 percent for each full year of delay, which can bring your payment to more than $5,000 a month if you contributed the maximum amount. But of course, not everyone can or wants to wait. Health, grandchildren, that mortgage that doesn’t pay itself… therein lies the dilemma.

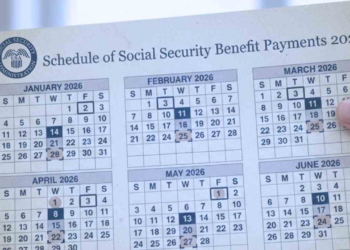

This year brought more than just age. The cost-of-living adjustment, the famous COLA, was 2.8%. It sounds modest, but for the average retiree, it means going from about $2,015 a month to $2,071. It’s not a massive increase, but it helps with milk and electricity.

Those retiring this year at a good age will receive up to $4,152 a month, if they were among those who paid the maximum contribution their entire working lives. At 62, it drops to $2,969. And if they reach 70, they approach $5,181.

Working in Retirement? The IRS Rule Change in 2026 You Can’t Ignore

Another detail that catches people off guard is the whole “work while you’re getting paid” thing. If you’re below the FRA (Federal Retirement Income) and earn more than $24,480 a year, they withhold one dollar for every two you earn over the limit. But in the year you reach full retirement age, the cap rises to $65,160, and the withholding is less severe: one dollar for every three.

Thereafter, you can earn as much as you want without them taking a penny. It’s as if the system is saying, “You’ve made it, now enjoy it.” The income threshold for contributions also rose to $184,500. Those who earn more pay more in Social Security taxes, but you already know that if you’re one of those people who actually look at their pay stub.

The curious thing is that this “silent” change was foreseen 40 years ago. But in the age of TikTok and bombarding notifications, it seems to have been lost in the noise. Only 13% of people know their exact FRA, according to surveys.

And you, do you know yours? Because if you were born in the 60s, there’s no going back. This isn’t meant to scare you, mind you. It’s meant to help you plan. Create an account on the Social Security website, enter your information, and see the projections. Talk to an advisor. Consider whether it’s worth continuing to work for a couple more years.