The arrangement is discreet, but for millions of retirees, disabled individuals, and survivors in the United States, it determines a crucial part of their monthly finances: the exact date their Social Security payment arrives in their bank accounts.

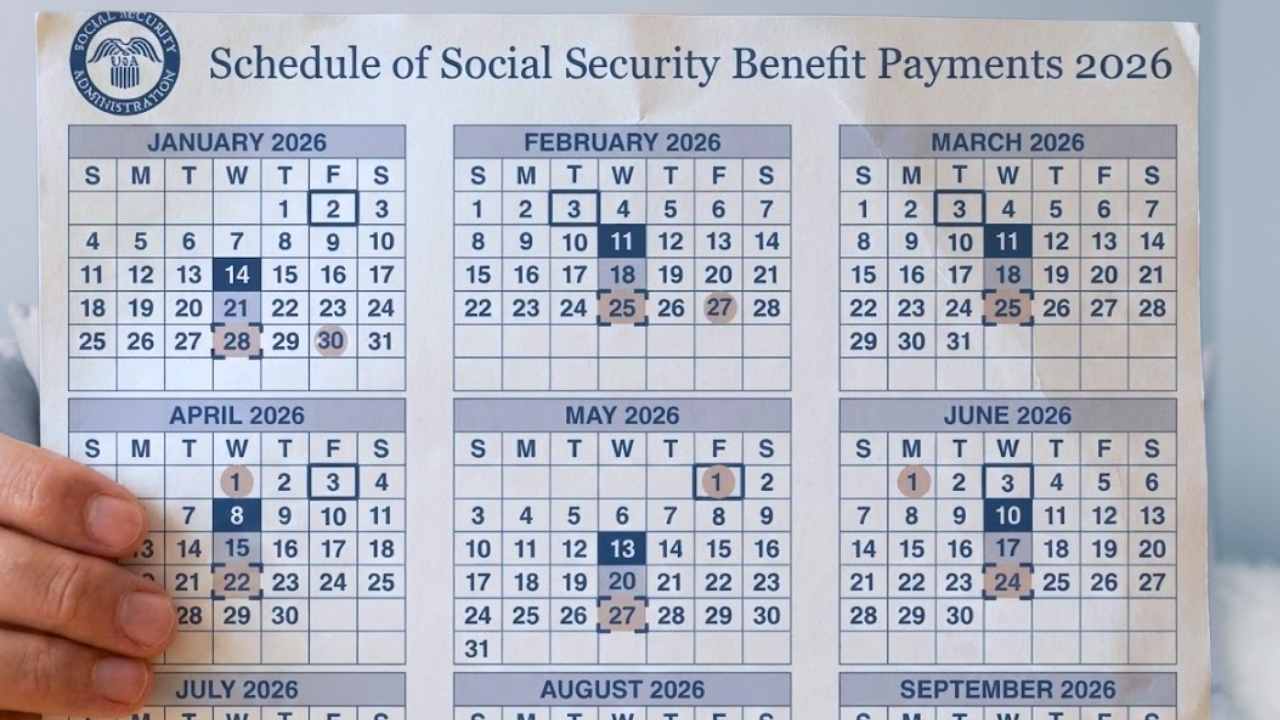

For February 2026, a month without holidays to complicate the schedule, the Social Security Administration (SSA) has already established its payment schedule, which distributes deposits following a seemingly simple pattern that many are unaware of.

The SSA Confirms the Full Schedule for February

The general rule is clear: most beneficiaries who began receiving payments after May 1997 will see the money deposited on one of the Wednesdays of the month. What determines the exact Wednesday? An immutable piece of personal information: the day of the month they were born.

Wednesday, February 11, is reserved for the first group: those whose birthdate falls between the 1st and 10th of any month. A week later, on February 18, it’s the turn of those born between the 11th and 20th. Finally, the cycle closes on February 25 for those who celebrate their birthday between the 21st and 31st of the month.

SSI or Retirement? The Big Difference in Your February Payment

There are established exceptions that operate in the same schedule. There is the longest-standing group of beneficiaries: those who were already receiving benefits before May 1997. For them, the schedule goes back. Their February payment was scheduled to arrive on Tuesday, February 3, 2026, regardless of their birthdate.

On the other hand, there are the beneficiaries of Supplemental Security Income (SSI), a need-based program. For them, February begins earlier: their payment is moved up to Friday, January 30, 2026. This adjustment occurs because February 1 of that year falls on a Sunday, and the SSA schedules payments for the preceding Friday.

The Bigger Picture: Who Has Access to These Funds

The payments that follow this meticulous schedule aren’t just for traditional retirees. The Social Security structure covers four broad categories of people. The largest is retirees who accumulated enough credits throughout their working lives.

The second consists of workers who suffer a severe and prolonged medical disability, covered by Social Security Disability Insurance (SSDI). The third category, often the most painful, is that of survivors: spouses, minor or disabled children, and sometimes dependent parents of a deceased worker who contributed to the system.

The fourth category, SSI, is different in nature. It does not require an employment history but is intended for older adults, blind people, or people with disabilities who demonstrate very limited income and resources. This group receives payments at the end of January.

A key factor in the 2026 budget for all beneficiaries is the Cost of Living Adjustment (COLA), which is projected to be 2.8% for that year. This increase, applied automatically since January, aims to mitigate the effect of inflation on the purchasing power of payments.

Maximum Retirement Benefits in 2026 Per Age

For the 2026 fiscal year, the SSA has set the maximum benefits at $2,720 for those claiming as early as 62 years old. Meanwhile, retirees who wait up to their Full Retirement Age (FRA), which is 67, the top could increase up to $3,880.

Finally, for those who wait to the maximum age that accumulates work credits, which is 70, the top payment is set by the SSA to $5,108.