Thinking about retirement can be daunting, can’t it? It’s not just about numbers, but about imagining daily life when work is behind you. In the United States, where each state feels like a different country, choosing where to settle down can make a huge difference in your quality of life and how long your savings last.

We’ve been looking into this closely and reading about other people’s experiences, and one thing is clear: cheap doesn’t have to mean isolated or lacking in amenities. In fact, some cities that previously seemed like nothing like retirement destinations are now flourishing, offering just the balance many people seek: the ability to live comfortably without feeling disconnected from essentials.

What to Look for When You’re Searching for a Place to Retire?

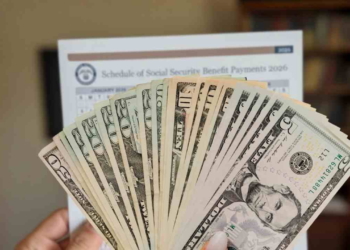

- Can I afford it in the long run? It’s not just about rent or mortgage payments. It’s the whole picture: the price of groceries, whether pension taxes are high or low, the cost of maintaining the house in winter and summer, and those small, everyday expenses that add up without you even noticing.

- Will I be able to age here with dignity and support? This is what it means to be humane. It translates to: Are there good doctors who understand age-related issues? Is it easy to get around if driving is no longer an option? Are there day centers, library activities, or accessible parks where I can meet other people? Does the community seem to care for its elders?

Retire in Peoria, Illinois

Peoria is a city that, due to its cost structure significantly below national standards, stands out as a popular destination for retirees. Economic reports place its cost of living at 24.4% lower than the national average. This is particularly evident in the real estate market, where the average home price has been recorded at $130,361.

The city has invested in a revitalized urban environment that benefits all residents. The network of parks and trails is extensive, and local museums have implemented programs specifically for seniors. These elements form a basic but crucial layer of infrastructure for older adults, promoting physical activity and access to culture without prohibitive costs.

The relaxed life for retirees in Sioux Falls, South Dakota

Sioux Falls has a slightly lower cost of living than the national average, with a difference of 3.7% lower. However, its housing market shows a higher average price, at $329,892. The financial advantage lies in other aspects, notably a tax policy considered very favorable for fixed incomes from pensions and retirement savings.

The city has developed a renowned infrastructure for the elderly, with hospitals offering specialized geriatric services. The existence of a wide range of organized recreational and social activities for older adults reflects intentional community planning. This approach mitigates the challenges of social isolation, a critical risk factor at this stage of life.

A City Combined With Countryside: Rochester, New York

Rochester offers a cost of living estimated to be 11.4% lower than the U.S. average. The median home price is reported at $231,623, placing it midway between the most affordable and the most expensive options.

Its main asset, however, is its exceptional senior healthcare infrastructure, as it is home to the renowned University of Rochester Medical Center. The city has an excellent cultural offering, with museums, orchestras and a nearby wine region.

Moving to Albuquerque, New Mexico, as a Retiree

In Albuquerque, the cost of living is 8% lower than the national average. The median home price is $316,580. Climate is a major factor in its appeal: a dry, sunny climate for most of the year attracts those seeking to avoid harsh winters, which can translate into better health and lower heating costs.

The city functions as a complete urban center, with all essential services and a remarkable proximity to natural environments. This characteristic fosters an infrastructure for seniors that values outdoor activities and an active lifestyle. Accessible pathways, public spaces, and a culture oriented toward community life are intangible but valuable assets.

Forever Summer: Tallahassee, Florida

Tallahassee boasts a particularly low monthly cost of living for homeowners, with estimates around $1,248 per month. The median home price is $185,037. Analysts often describe it as offering the best value for money, combining a subtropical climate, state taxes favorable to retirees, and a high livability index.

Having a campus of the Florida State University brings a vibrant cultural scene and a wealth of resources that often benefit the senior population. The university’s infrastructure for older adults is strengthened by its continuing education programs and accessible events. The city exemplifies how an educational environment can enhance the availability of services and activities for all age groups.