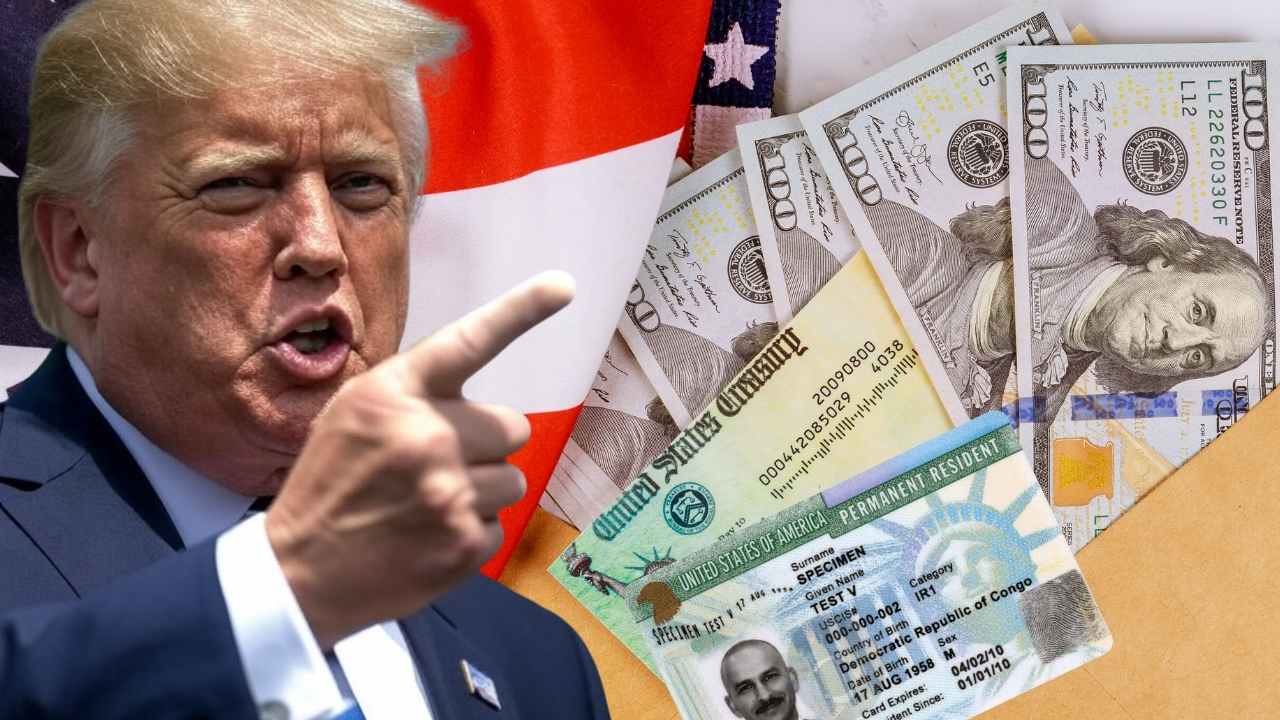

The United States has one of the most complex and intricate tax systems in the world, and now this web of back-and-forth tax returns, payments, collections, and debts intersects with the right to citizenship, which could be at risk for naturalized Americans… if they lied on their tax returns.

U.S. citizens, including former green card holders, face potential denaturalization lawsuits, the Department of Justice (DOJ) explained, ordering it to prioritize revocation of citizenship for fraudulent acquisition.

Expansion of criteria for denaturalization due to tax incidents

Under recent administrations, underreporting income on tax documents has become a potential ground for initiating denaturalization proceedings. This shift in approach has been documented, with tax violations potentially resulting in the loss of citizenship.

The Justice Department’s Civil Division included denaturalization among its top five operational priorities. The guidelines target individuals in ten specific areas, in addition to “any other cases” that authorities deem sufficiently relevant for prosecution.

A case cited by Bloomberg Law involves a Houston resident whom prosecutors are seeking to strip of her citizenship. She had completed the naturalization process years earlier, but in 2019 faced tax fraud charges. The defendant pleaded guilty to failing to fully report her income, improperly receiving a refund of $7,712. Her sentence included 12 months in prison and fines.

Although the tax offense occurred after obtaining citizenship, the Department of Justice bases the denaturalization action on the alleged “intentional concealment or misrepresentation of a material fact” during the original immigration process. This criterion allows revocation even for citizens who originally entered as green card holders.

The IRS 2025 tax calendar is still ongoing

The 2025 tax filing season began on January 27, according to the Internal Revenue Service (IRS) schedule. Most refunds are processed within 21 days of the return being accepted, particularly for taxpayers who file electronically and opt for direct deposit.

However, certain factors cause delays. Claiming specific tax credits such as the Earned Income Tax Credit or the Additional Child Tax Credit triggers additional reviews. By law, refunds that include the latter credit cannot be issued before mid-February.

The regular filing deadline ended on April 15, 2025. Those who requested extensions have until October 15 to file their returns. This window explains why some refunds could be issued in August 2025, especially in cases that require additional verification or error correction.

There are state refunds, additional to those from the IRS

Some states implemented special refund programs during 2025. Georgia operated under House Bill 112, issuing refunds starting in June to taxpayers who filed 2023 and 2024 returns before May 1. Its online portal indicates that most have already been distributed.

North Carolina faced delays in paper check refunds due to issues with the printing provider, with updates reported through May. Furthermore, New York scheduled its inflation refund checks for issuance starting in mid-October. No state announced specific mass issuances for August.

State jurisdictions process late refunds according to their own timeframes. Massachusetts indicates a 4- to 6-week period for electronic returns. Therefore, taxpayers who file around October 15 could receive state refunds in August if their cases require minimal processing.

How to find your tax refund, if it hasn’t arrived yet

Federal taxpayers can use the “Where’s My Refund?” tool on IRS.gov, updated every 24 hours for electronic returns. It requires a Social Security number, return status, and exact refund amount. Paper returns take approximately four weeks to appear in the system.

At the state level, portals such as tax.ny.gov in New York and the Georgia Department of Revenue website offer similar systems. North Carolina launched an online tracker after several reported delays in physical checks.