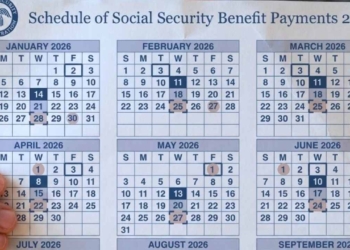

Today, Wednesday, October 15, millions of Americans will feel the tangible relief of their Social Security deposits, a weekly reminder of the safety net that sustains the nation in turbulent times. For those born between the 11th and 20th of each month, this is payday, part of a meticulous schedule designed by the Social Security Administration (SSA).

The retirement benefit, by today, average around $2,008 per month for senior citizens. These electronic deposits—or mailed checks for those few who are behind—inject vitality into local economies from the coasts of Florida to the Dakota prairies.

But there’s no time to celebrate: in a week, on October 22, the fourth wave of payments will arrive, intended for those born between the 21st and 31st, closing the October cycle with a collective sigh before November brings its own pressures. October 8th saw the first round for those born on the 1st through 10th.

Social Security deposits: what to expect at the end of the 2025 fiscal year

In a year marked by residual inflation and incipient tariffs, these cash flows are more than transactions: they’re lifelines. These payments, adjusted for the 2.5% COLA announced last year, give recipients a modest respite, but in a context where housing prices have risen 7% annually, every dollar counts.

The SSA serves over 70 million Americans, with benefits received by retirees and their surviving relatives, workers with disabilities (SSDI benefits), and how-income individuals (SSI benefits).

When will the retirement benefits increase for 2026?

As beneficiaries check their accounts this morning, attention inevitably shifts to the horizon: the cost-of-living adjustment (COLA) for 2026, whose official confirmation is just nine days away. The SSA has reiterated that the announcement will come on October 24, regardless of the shadows of a government shutdown looming in Congress.

The Bureau of Labor Statistics (BLS) will release the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) for September at 8:30 a.m. ET, and the agency will translate that number into a binding percentage for payments starting January 1.

“The COLA will be implemented on time, even during the shutdown,” an SSA spokesperson told US media, emphasizing that automatic payments are protected by law.

Amid this tug-of-war, projections for the 2026 COLA offer a picture of muted hope. After the 2.5% rate in 2025, experts estimate a 2.7% increase, according to the Senior Citizens League (TSCL), driven by inflation that, although tamed at 2.4% annually, persists in areas such as healthcare (up 4.2%) and energy.

Calculations for the 2026 Social Security benefits

Under this scenario, the average benefit for a retiree would rise to $2,062 per month, a $54 bonus that could cover a tank of gas or a doctor’s visit. AARP raises the stakes to 2.8%, which would add $56, while independent analysts such as Mary Johnson of TSCL warn: “This is progress, but it doesn’t offset the 25% increase in food prices since 2020.”

This optimism clashes with the political backdrop. With the fiscal year expiring on October 18th, Republicans are demanding cuts in social programs to balance a $1.9 trillion deficit, while Democrats defend the COLA as an untouchable pillar.

A shutdown, like those of 2013 and 2018, could pause non-critical BLS data, but the SSA swears that the CPI-W is “mission essential.” “It’s bureaucracy winning over paralysis,” quips Johnson, who recalls how past shutdowns delayed disability processing, leaving thousands in suspense. In Florida, for example, widows like 72-year-old Rosa Martinez fear the worst: “My paycheck on the 15th is my salvation; if the government shuts down, who will save us?”.