For millions of American retirees, the second Wednesday in October marks a crucial date on their financial calendar. Today, October 8, 2025, the Social Security Administration (SSA) is depositing long-awaited retirement benefits for a wide range of beneficiaries, a monthly reminder of the program that sustains generations.

However, this routine payment comes amid growing uncertainty, as the government shutdown that began last week could delay the announcement of the cost-of-living adjustment (COLA) they will receive next year, adding anxiety to households’ financial planning.

Social Security Drops Today for Millions: Shutdown Shadow Casts Doubt

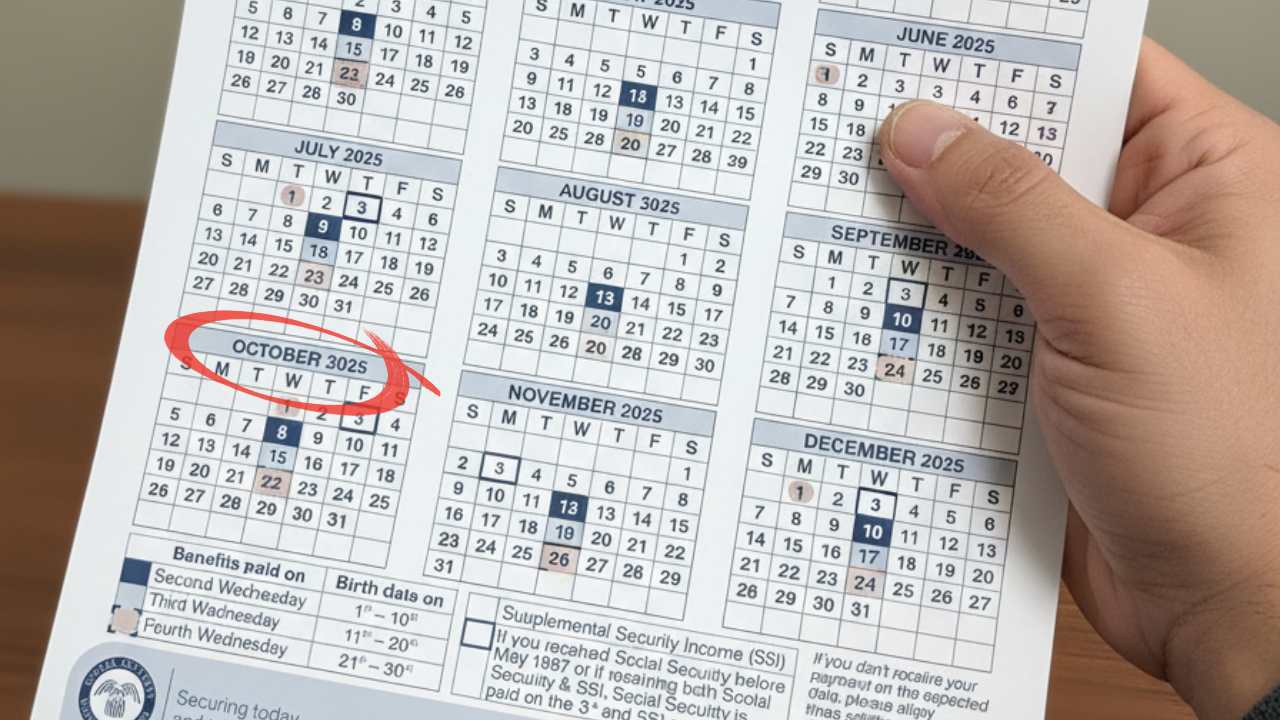

The SSA payment system operates with precise timing, distributing funds on three Wednesdays throughout the month. Receipt of the benefit depends directly on the beneficiary’s date of birth. Those whose birthdays are between the 1st and 10th of the month, as is the case with this payment on October 8th, are the first to receive their benefits.

However, about two-thirds of beneficiaries must be patient. Those with birthdays between the 11th and 20th of the month will see their accounts credited on Wednesday, October 15th. Meanwhile, those born in the last decade of the month, from the 21st to the 31st, will have to wait until Wednesday, October 22th to access their funds.

Retirement Numbers: From Average to Maximum Payments

The amount that reaches each individual account is as diverse as the beneficiaries’ careers. According to official SSA data for 2025, the average monthly payment for a retiree is around $1,915. This figure, for many, represents the cornerstone of their monthly finances.

At the other end of the spectrum, there is a select group of retirees who receive the maximum benefit. This year, that limit has been set at $5,108 per month. Achieving this figure is not a matter of luck; it is the result of a combination of factors that require meticulous career planning.

To qualify for this amount, a person must have contributed to the system for at least 35 years, have earned income equal to or greater than the maximum contribution base in each of those years, and, crucially, have postponed their retirement application until the maximum age of 70. This delay allows for “delay credits” to substantially increase the benefit amount.

How a Government Shutdown Could Freeze 2026 COLA Data

As retirees receive their October paychecks, a shadow of uncertainty hangs over their financial outlook for 2026. The mechanism that determines the annual increase in benefits, known as the Cost of Living Adjustment (COLA), is at risk of being delayed due to the government shutdown that went into effect on October 1.

In a normal year, in the middle of this month, Social Security officials would announce with great fanfare the COLA percentage for the following year, based on Julyl, August, and September inflation data provided by the Bureau of Labor Statistics (BLS).

However, the current reality is very different. The shutdown has forced the BLS to furlough the vast majority of its staff and halt the publication of all its statistical reports. The machinery that produces official economic data has ground to a halt.

What’s the Possible COLA Expected for 2026?

Private sector analysts, working with information available from July and August, project that the COLA for 2026 will be around 2.7%. If confirmed, this would translate into an increase of approximately $54 in the average monthly benefit, bringing it to approximately $1,969. Although modest, this increase is vital to helping retirees maintain purchasing power in the face of rising housing, energy, and healthcare costs.

The duration of the government shutdown is the variable to have on the top of mind. If Congress reaches an agreement to reopen institutions in the coming days, the BLS would likely prioritize the release of the pending data, and the COLA announcement would only be delayed by a few weeks.

But if the shutdown extends into October, the announcement could be indefinitely suspended, leaving millions of Americans without critical information for planning their budgets for next year.

Will the Social Security Payments Be Delayed?

Meanwhile, existing payments continue. The law establishes that Social Security benefits are a permanent mandatory expense, making them immune to the vagaries of government shutdowns. Thus, retirees can count on their monthly deposits arriving on time, just as they have on this second Wednesday in October.

The question that hangs in the air, and for which no one yet has an answer, is how much—and when—this essential payment will increase starting in January.