Officially, we’re not playing a game: The definitive announcement of the annual cost-of-living adjustment (COLA) for 2026 has been postponed indefinitely due to the partial federal government shutdown, which could affect the deposit of Social Security benefits.

The measure, which directly impacts more than 72 million retirees and other beneficiaries, including retirees, people with disabilities, and survivors, leaves families on edge due to economic uncertainty at a time when inflation continues to erode purchasing power.

What is the Social Security COLA adjustment?

According to several government departments, the delay is a direct consequence of the government shutdown, a mechanism that was activated when Congress failed to approve the federal budget for fiscal year 2026, with cuts to programs like Social Security.

The COLA is one of the most vital mechanisms in the Social Security system, designed to protect benefits against rising prices. Historically, this adjustment is calculated using the Consumer Price Index (CPI-W), as measured by the Bureau of Labor Statistics (BLS).

The traditional announcement is made in October, allowing the increase to be implemented in January checks. For 2025, the COLA was 2.5%, a modest respite from inflation that reached 8.5% in 2022. Experts estimate that, based on preliminary data from

September, the adjustment for 2026 could be around 2.8% or 3.1%, which would represent an additional $50 to $70 per month for an average beneficiary earning $1,800. However, without an official announcement, these calculations remain in limbo.

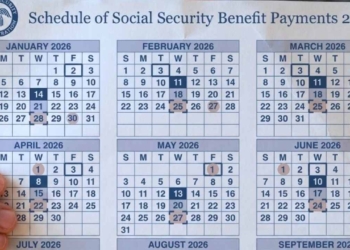

The next Social Security payments

Although the federal government shutdown remains in effect, October payments are proceeding well so far, but there could be some difficulty in making payments to the millions of beneficiaries in November.

The amounts approved for November depend, as usual, on a case-by-case basis, but there are maximum benefits based on the age at which a recipient claimed their first payment. For a claim at age 62, the maximum monthly benefit is $2,831, showing a 30% actuarial reduction from the full Primary Insurance Amount (PIA) of $4,018.

This option is ideal for those who need immediate income, but it sacrifices up to a third of the total potential and only applies to eligible workers in 2025 with 35 years of contributions to the maximum.

Maximum payments for retirees

At Full Retirement Age (FRA), which is 67 for those born in 1960 or later, the maximum benefit reaches $4,018 per month, equivalent to 100% of the PIA, with no additional reductions or increases.

This base amount is calculated by applying the SSA’s progressive formula to the Average Indexed Monthly Earnings (AIME), considering 90% of the first $1,226, 32% up to $7,391, and 15% of the excess.

Finally, for those who delay their claim until age 70, the maximum monthly benefit rises to $5,108, an increase of 24% to 32% over the PIA (Income Tax) thanks to the 8% annual late payment credit. This is the absolute limit of the system, as there are no increases beyond that age.

For now, and until December 2025, regardless of the COLA approved for next year, these are the current amounts.