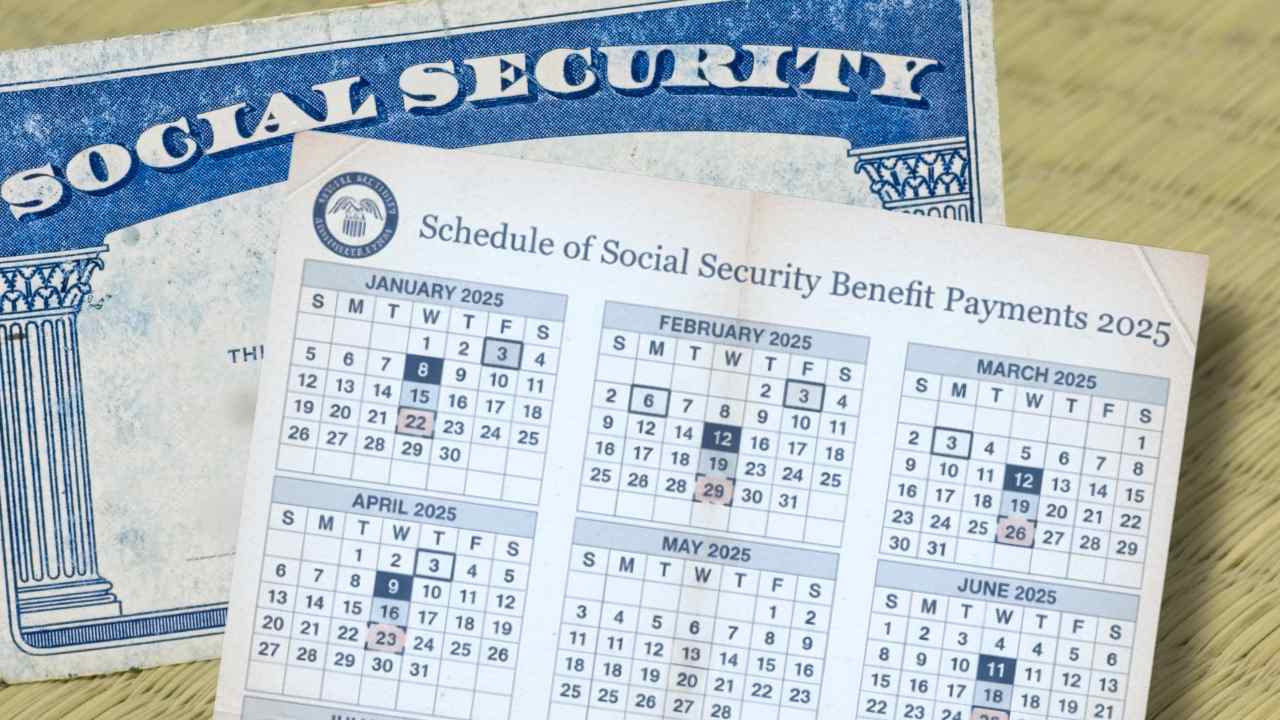

In an October that already feels longer than usual for millions of American retirees, the final Social Security benefit payment administered by the Social Security Administration (SSA) arrived on time for many, but against a backdrop of uncertainty. The first two groups (birthdates 1-10, and 11-20) arrived on the second and third Wednesdays.

For those born between the 21st and 31st of any month, the deposit falls on Wednesday, October 22, 2025, closing the payment cycle for that period. And let’s not forget Supplemental Security Income (SSI) recipients, who will see an extra payment on October 31—although, technically, that counts for November, since the first of the month landed on a weekend.

Other Social Security payments already issued on October

Before that, the October calendar included disbursements on the 1st for SSI, the 3rd for veterans in the system or those who combine benefits, the 8th for those born between the 1st and 10th, and the 15th for those born between the 11th and 20th.

But let’s get to what beneficiaries are really worried about: How much can they expect in maximum payments, depending on when they decide to retire? In 2025, the figures vary by age and already include the 2.5% cost-of-living adjustment (COLA) that went into effect in January.

If you choose to retire at 62—the minimum age—the monthly cap is around $2,831. Wait until full retirement age, which is 67 years old for those born in 1960 or later, and you could see up to $4,018 a month.

And if you’re patient enough to reach 70 years old, thanks to those late payment credits, the maximum rises to $5,108. Sounds tempting, right? Of course, as long as inflation doesn’t eat up those extra dollars before they reach your pocket.

The COLA 2026 announcement is employed

Speaking of inflation, the big topic of the moment is the possible COLA increase for 2025—well, actually, the one that is now being announced for implementation in January 2026. Preliminary estimates point to a modest increase, between 2.7% and 2.8%, calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from July to September.

It’s not the boom we saw in past years, but for more than 72 million people who rely on these deposits, every percentage point counts. The problem is that the announcement, which usually falls around October 15, has been postponed until the 24th.

The culprit? The government shutdown that has gripped Washington since the beginning of the month, paralyzing key agencies like the Bureau of Labor Statistics (BLS). Without the final September CPI data, the SSA can’t crunch the final numbers.

What the experts say about the Social Security COLA

Experts like Mary Johnson of The Senior Citizens League have expressed frustration: “This delay not only creates anxiety, but it complicates planning for families living paycheck to paycheck.” Meanwhile, in Congress, negotiations to reopen the government appear stalled, with Republicans and Democrats blaming each other.

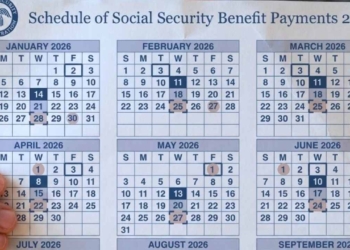

Once the curtain rises and the COLA is announced, it will take effect in January 2026, automatically adjusting payments. Until then, be patient: October is already halfway through, but for many, the real relief will come with that extra percentage.

If you’re planning your retirement, it might be time to review those benefit tables—and cross your fingers that the shutdown doesn’t extend any further.