What seemed like a definitive victory for hundreds of thousands of American retirees on Social Security is turning into a new bureaucratic battlefront in the capital.

The repeal of the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) promised financial relief for teachers, firefighters, and police officers who saw their benefits eroded for years. However, the way the Social Security Administration (SSA) is interpreting retroactive payments has set off alarm bells on Capitol Hill.

A New Social Security Fix Is Coming

At stake is the possibility that nearly 2.8 million affected Americans will receive a substantial new lump-sum payment. The fine print of the Social Security Fairness Act, which took effect last year, stipulated that beneficiaries should receive a full payment for benefits accrued since January 2024.

However, the SSA, in its technical application, has limited those retroactive payments to just six months for numerous claimants, creating a six-month gap in the financial compensation that many had taken for granted.

“We don’t blame the SSA for not having a crystal ball,” Senators Bill Cassidy (R-Louisiana), John Cornyn (R-Texas), and John Fetterman (D-Pennsylvania) wrote in a letter to the agency earlier this month. The letter, unusually sympathetic but firm, argues that Congress made no distinction between new and old beneficiaries when setting the effective date, and that the SSA should not cling to the “plain text” of the law to the detriment of retirees.

A Loophole in the New Law Left Millions of Retirees Shortchanged

Bipartisan pressure is pushing the SSA to recalculate these payments and extend them to a full year. For many, such as retired teachers who combined years in public education with jobs in the private sector, the difference between six and twelve months of retroactive payments can amount to several thousand dollars.

These workers were historically penalized because, although they contributed to Social Security, their public pensions artificially reduced their benefits.

However, the viability of this amendment runs headlong into the agency’s harsh fiscal reality. The SSA faces a funding crisis that, according to experts, could leave the trust fund unable to pay full benefits within the next decade, specifically by 2033.

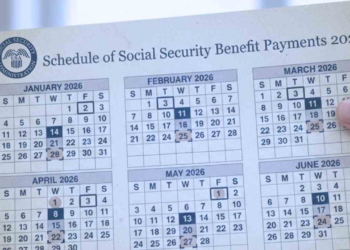

The Maximum Social Security Benefits in 2026

To put the SSA figures into context, it’s crucial to understand that a retiree’s monthly pension payment depends directly on the age at which they choose to stop working. According to official data for 2026, a person who has contributed to the system at the maximum taxable income level for 35 years and decides to retire at age 62, the earliest possible age, will receive a maximum payment of $2,969 per month.

This is a permanent reduction of approximately 30%, money that a beneficiary will never be able to recover, because that’s what they accepted when they opted to claim so early.

If that same worker waits until reaching their full retirement age (FRA), currently 66 for those born between 1943 and 1954, but 67 for most new retirees in 2026 (born in 1960 or later), the maximum benefit is $4,152 per month, representing 100% of their calculated benefit.

However, the real reward comes for those who can delay their application until age 70; by accumulating delayed retirement credits, which increase the payment by 8% annually after FRA, the maximum check jumps to $5,181 per month, becoming the highest amount the administration can offer in 2026.