If you’re waiting on your Social Security deposit, here’s some good news: millions of Americans are set to receive payments this week, with some amounts reaching as high as $5,108. This comes during a partial government shutdown that’s now in its 20th day, creating significant headaches for local Social Security offices.

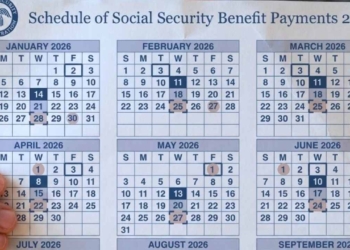

According to the payment schedule, the third round of October benefits—covering both retirement and disability—starts hitting bank accounts on Wednesday, October 22nd. The biggest payments, maxing out at $5,108, go to people who waited until age 70 to retire.

This batch is mainly for beneficiaries whose birthdates are between the 21st and the 31st days of any month. The agency has been quick to reassure everyone that the money will still go out on time, thanks to funding that’s already in place. That’s a major relief for the roughly 66 million people who count on this income.

The Social Security offices are closet due to federal shutdown

But it’s not all smooth sailing. If you need to actually visit an office for help, you might run into problems. Since the shutdown started on October 1st, services have been scaled back. This has led to some offices shortening their hours, postponing appointments, and putting a hold on certain services like new benefit applications or appeals.

In big states like California, Texas, and New York, many locations have cut back on non-essential operations, leaving a lot of people in the lurch. An SSA spokesperson noted that this situation “creates a lot of uncertainty for folks, especially when they’re counting on these payments.”

This shutdown, the first major one since 2019, stems from the usual political gridlock over the federal budget. It’s not just Social Security that’s affected—programs like SNAP benefits and WIC are feeling the pinch too.

While the electronic payments are still going out without a hitch, the SSA is encouraging people to use online services to avoid any potential mail delays.

The COLA 2026 is also delayed: What to expect

If this political standoff drags on, experts are warning that it could really start to bog down the system for things like appeals and verifying eligibility. For now, the best bet is to check your payment status online or by phone, as those services are still running. Meanwhile, pressure is building on Congress to find a solution before the most vulnerable citizens are hurt even more.

On a slightly brighter note, there’s some talk about next year’s cost-of-living adjustment, or COLA. Early guesses point to a 2.7% bump in 2026, which is a bit more than the 2.5% increase we saw this year. Based on the latest inflation numbers, that could mean an extra $54 or so each month for the average retiree.

But the official word, which was supposed to come on October 24th, is now delayed because of the shutdown. That’s just adding more stress in a year that’s already been pretty rocky.

Advocacy groups say even a modest increase would help with rising costs for basics like food and rent, though it probably won’t be enough to fully make up for how much more expensive everything has gotten.

Is the COLA enough to cover inflation?

Looking down the road, this expected COLA is a small bit of good news, but it also shows that the Social Security system itself needs some serious attention. There are real concerns about the long-term health of the retirement fund, and ideas are being floated—like changing the full retirement age or tweaking taxes for higher earners.

With the shutdown still going, the big question is whether Washington can not only fix the immediate problem but also make sure the system is solid for the future. For now, the best advice is to keep an eye on official updates online and plan your budget carefully. The real challenge, after all, is making sure the system works for everyone without breaking the bank.