New York State administers the STAR Stimulus Checks program, a tax relief initiative specifically targeting school taxes. Officially called School Tax Relief, this program does not constitute a broad-based federal economic stimulus.

It operates by providing a refund or credit, delivered through a physical check or direct deposit, intended to subsidize a portion of property taxes allocated to education. The approximate annual distribution is $2.2 billion, benefiting approximately 3 million homeowners in the state.

The Basic STAR and the Enhanced STAR: particularities and difference

Eligibility for these benefits is subject to defined criteria. Applicants must own a home located in New York City that is their primary residence. Combined income thresholds apply to applicants and their spouses. For Basic STAR, this income cannot exceed $500,000.

For Enhanced STAR, known as E-STAR, the homeowner must be 65 years of age or older and the annual household income must not exceed $107,300. The program allows those who have received the exemption since 2015 to continue to live in the same property, provided they maintain the requirements.

Regional distribution of the stimulus checks

Individual payment amounts are not fixed, as their calculation depends on the local school district, the type of STAR awarded, and the property tax value of the home. For fiscal year 2025, preliminary estimates place the benefit range for Basic STAR between $350 and $600 per household.

. For Enhanced STAR recipients, the projected amounts are significantly higher, ranging from $700 to $1,500. The maximum amount of $1,500 typically accrues to homeowners in districts with higher school tax burdens.

The total $2.2 billion allocation is distributed unevenly across the state, pointing demographics and property values. Long Island is the largest recipient of funds, with a total distribution of $698.4 million. The Mid-Hudson region follows with $488.5 million.

Other areas receive smaller allocations, including the Finger Lakes with $205.2 million, Western NY with $178.5 million, and NY’s STAR program offers school tax relief. It is not a federal stimulus but a state refund for primary homeowners $158.6 million. The rest of the state shares the remaining funds, with the North Country receiving the lowest amount, $47.2 million.

Tax refund checks are gone now forever

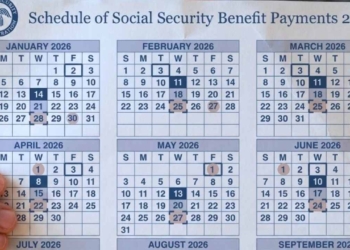

Initial payments began processing in late June, extending into the fall. This schedule is tied to local tax payment deadlines in each jurisdiction. For residents of major urban centers such as New York City, Buffalo, Rochester, and Syracuse, the delivery period was concentrated between late June and mid-July.

For beneficiaries of the Enhanced STAR program, the distribution window is later. Checks, with values up to $1,500, began being sent in September. This process is estimated to continue until the end of 2025, with most payments expected to materialize during October.

Tax authorities indicate that, once the payment is issued, taxpayers should allow 5 to 10 business days to receive the check by mail or to see the direct deposit into their bank accounts.