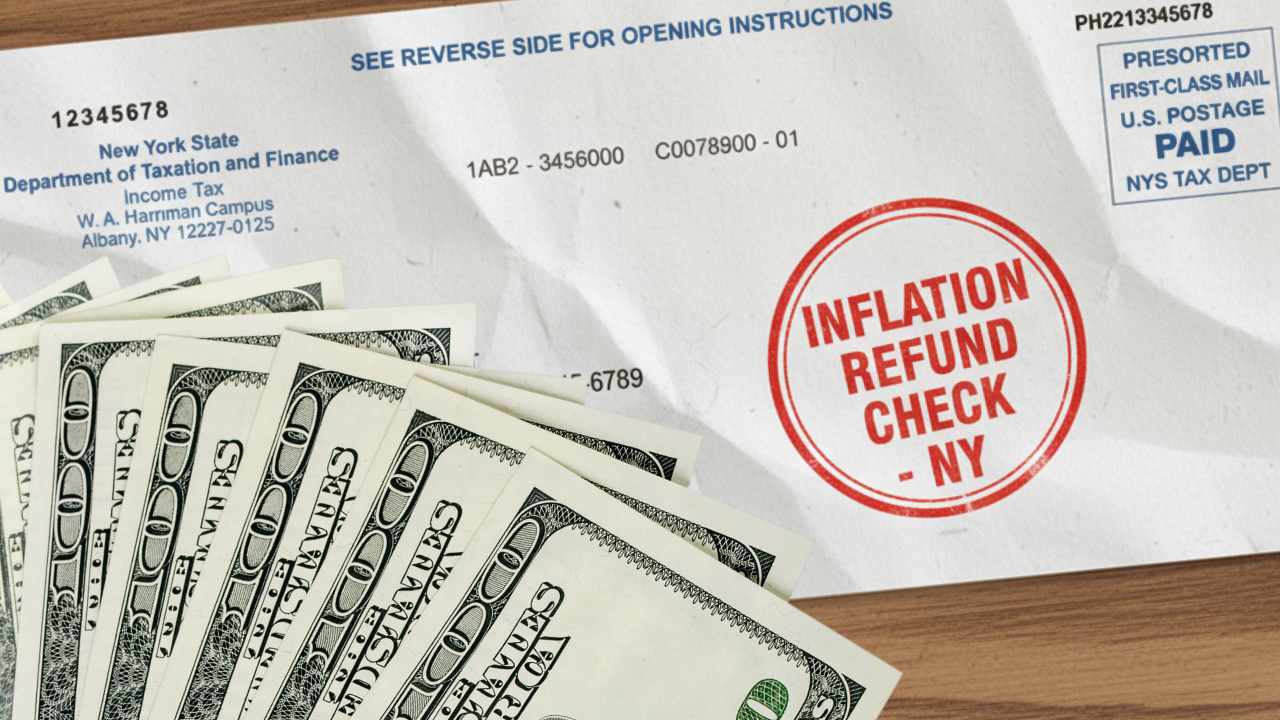

New York State has initiated a disbursement of one-time payments termed Inflation Refund Checks. This measure, embedded within the fiscal year 2025-2026 state budget, allocates an estimated two billion dollars for distribution.

The program’s objective is to provide a partial offset to the impact of rising prices, which previously resulted in higher-than-anticipated state sales tax collections. New York’s estimations concluded that around 8 million households will be getting this tax refund checks.

New York Inflation Check This Fall

Official estimates indicate the initiative intends to reach over eight million households across the state. The disbursement amounts are structured to range from $150 to $400 per eligible individual. The specific sum a resident receives is contingent upon their adjusted gross income and their official tax filing status, such as single, married, or head of household.

To qualify for a payment, an individual must have been a full-year resident of New York State for the 2023 tax year. The New York State Department of Taxation and Finance has stated that partial-year residents are automatically excluded from receiving the benefit, regardless of their income level during their period of residence.

Eligibility Requirements and Income Thresholds for the NY Tax Refunds

A fundamental prerequisite is the timely filing of a state income tax return for the 2023 fiscal year using form IT-201. Residents who failed to file this return, either by obligation or choice, are ineligible for the payment.

Furthermore, any individual who was claimed as a dependent on another person’s tax return is also disqualified from receiving their own refund check.

Here’s the income brackets and payment amounts for New York’s Inflation Refund Checks:

- Single Filers:

- Up to $75,000 AGI: $200

- $75,001 – $150,000 AGI: $150

- Married Filing Jointly:

- Up to $150,000 AGI: $400

- $150,001 – $300,000 AGI: $300

- Married Filing Separately:

- Up to $75,000 AGI: $200

- $75,001 – $150,000 AGI: $150

- Head of Household:

- Up to $75,000 AGI: $200

- $75,001 – $150,000 AGI: $150

- Qualifying Surviving Spouse:

- Up to $150,000 AGI: $400

- $150,001 – $300,000 AGI: $300

NY State Tax Rebate Checks: Arrival Dates

The state agency will administer the distribution of checks automatically, eliminating any need for an application process. Payments will be mailed via the United States Postal Service to the address on file from the most recent tax return. The state has confirmed it will not create a dedicated portal for advance claims or requests related to this specific program.

The mailing of checks is scheduled to commence in late September 2025. Officials project the distribution will extend over several weeks, with no publicized timetable organized by geographic region or zip code. Consequently, some taxpayers can anticipate receipt in early October, while others may not receive their check until November.

What Kathy Hochul Say About

Governor Kathy Hochul’s administration has characterized the program as a mechanism to return money to working families following a period of significant inflationary pressure. The rationale is that residents contributed indirectly to the state’s elevated sales tax revenue through increased spending on goods and services, justifying a return of a portion of that surplus.

The refund checks are one component of a broader budgetary package that includes an expansion of the child tax credit, funding for free school meals, and other targeted middle-class tax relief initiatives. Collectively, these measures are intended to mitigate the high cost of living within the state.