A state audit report issued by Scott Fitzpatrick details that a legal amendment in Missouri, designed to extend the deadline for taxpayers to recover overpayments of sales and use taxes, has resulted in a growing volume of unclaimed tax refunds.

Although the audit rates the department’s oversight of the process as “good”, the document highlights a number of structural deficiencies that have allowed both the amount and monetary value of these tax refund funds to more than double over the past five years.

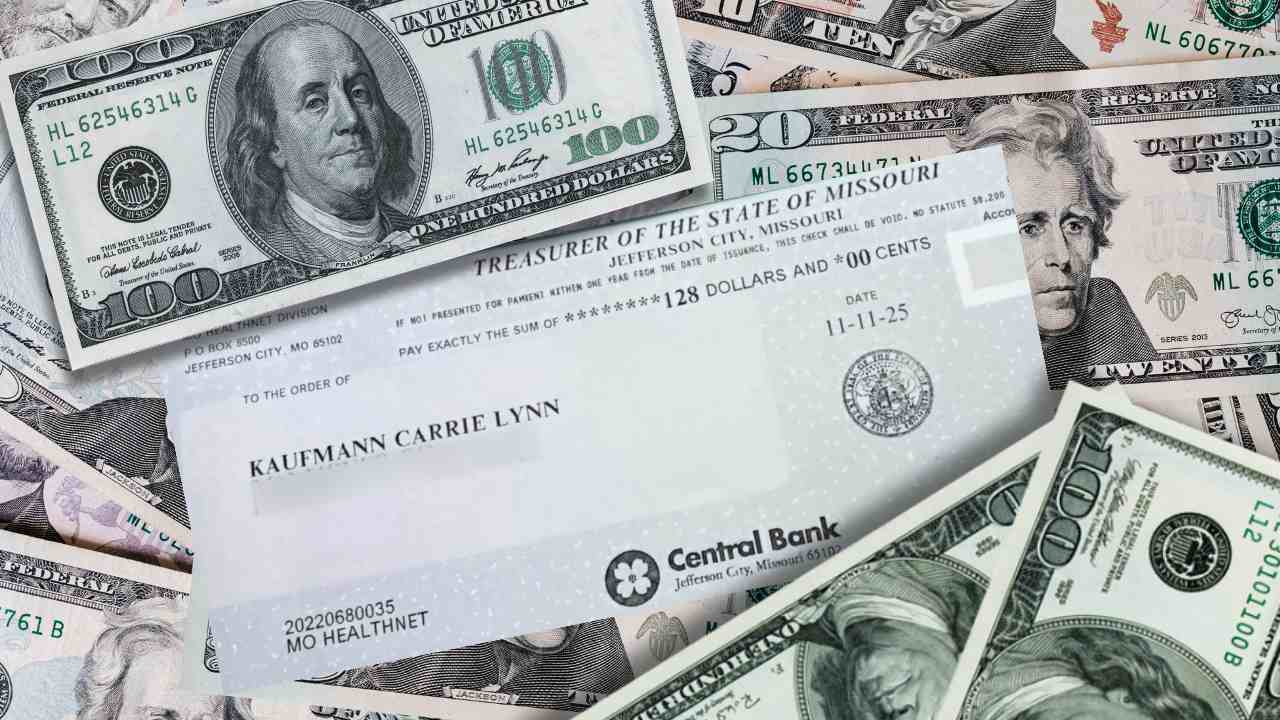

Missouri tax refunds: Hundreds of millions of dollars unclaimed

Auditor Fitzpatrick indicated that the 2019 amendment, which extended the window for claiming refunds from 3 to 10 years, has failed to optimize the efficiency of returning capital to taxpayers. “If the goal is to return tax money to those who overpaid—and clearly that should be the goal—then the system we have now is not doing that efficiently,” Fitzpatrick said.

The auditor urged lawmakers to examine the report’s findings and consider implementing improvements to the current system. Fitzpatrick also proposed that unclaimed tax overpayments be transferred to the unclaimed property program administered by the State Treasurer, an entity specializing in the restitution of financial assets to residents.

A state law that changed everything for taxpayers

The 2019 legislation extended Missouri’s eligibility period for reimbursements far beyond that of most states, which typically allow only four years to file claims. However, this extension has not resulted in a proportional increase in reimbursement requests.

Conversely, the inventory of identified overpayments increased from approximately 414,000 at the end of fiscal year 2019 to around 842,000 at the end of fiscal year 2024. The cumulative value of these excess payments experienced a growth of 59 percent, going from approximately $113.5 million to $180.5 million in the same period.

Procedure for claiming tax refunds in Missouri

Missouri taxpayers who are eligible for sales tax refunds and have not yet filed a claim should begin the process by completing Form 472P, also know “Purchaser’s Claim Under Section 144.190.4(2) for Sales or Use Tax Refund.”

This form requires a detailed list of exempt purchases, including supporting exemption certificates or letters, along with a worksheet detailing the refund amount. All relevant invoices that clearly demonstrate overpayment of the tax must be attached to support the claim.

If the refund amount requested exceeds $100,000, it is an additional requirement to include the ACH Refund Agreement, known as Form 5378. In cases where the person processing the request is not the owner, a partner, or an authorized officer of the business, a duly completed Power of Attorney must be submitted using Form 2827.

Once all supporting documentation has been gathered, the procedure varies slightly depending on the type of tax. For consumer use taxes paid directly to the Department, amended tax returns must be included for each affected period.

For sales or vendor use taxes, Form 5433 or Form 5440 must be submitted as an original copy, notarized and signed by an authorized official or employee. The maximum period for filing a claim is ten years from the due date of the original return or the effective date of payment, a rule applicable since August 2019.

What to expect after submitting the application

The completed application, along with all supporting documentation, must be mailed to the Missouri Department of Revenue, Taxation Bureau, PO Box 3350, Jefferson City, MO 65105-3350. Upon receipt, the department reserves the right to request verifications or additional documentation to process the claim.

Generally, a 30-day period is granted to respond to these additional requests. The burden of proof rests with the taxpayer to demonstrate the validity of their claim. If the refund request is denied by the Department of Revenue, the taxpayer has a 60-day period to file a formal appeal with the state’s Administrative Hearing Commission. Head to the official website, https://mytax.mo.gov/,for further information.