Colorado taxpayers begin organizing their paperwork for tax season, while a modest yet symbolic state refund awaits them. It’s the constitutionally mandated refund required by the TABOR Amendment, a mechanism unique in the nation that this year will return approximately $293.3 million to residents’ pockets.

However, this figure, far from the billions of previous years, and official projections announcing its possible temporary elimination next year, paint a complex fiscal picture and reignite the perennial debate about tax restrictions in the state.

Colorado is Returning Money: Are You One of the Beneficiaries?

The Taxpayer’s Bill of Rights (TABOR), approved by voters in 1992 and enshrined in Article X, Section 20 of the state constitution, acts as a constitutional check on government growth. Its best-known rule is simple: if state tax revenues exceed a limit calculated annually based on inflation and population growth, the excess must be returned to the citizens, unless they authorize its withholding at the ballot box.

A significant exception was introduced in 2005 with Referendum C, which allowed the state to withhold funds above a base limit for a time, creating an upper cap. However, any revenue exceeding even that adjusted cap remains subject to repayment.

Colorado’s Unique Tax Mechanism Triggers Payouts

The process is technical and meticulous. Every July 1st marks the beginning of a new fiscal year for the state. The surplus limit is adjusted using the Denver-Aurora-Lakewood metropolitan area Consumer Price Index and population growth data from the Department of Local Affairs.

Nonpartisan technical offices, the Legislative Council Staff (LCS) and the Office of State Planning and Budgeting (OSPB), publish quarterly forecasts in March, June, September, and December. Final certification of the surplus occurs the fall following the close of the fiscal year.

For the 2026 repayment cycle, corresponding to fiscal year 2024-2025, which ended June 30, 2025, the officially certified figure is $296.1 million. After accounting adjustments for overpayments from prior years, the net amount available for distribution is $293.3 million.

This is a significantly smaller surplus than that experienced in the post-pandemic period, when the combination of federal aid and a strong economy generated record surpluses.

Goodbye to Big Checks: The New Era of TABOR Refunds

More alarming to some, or encouraging to others, are the projections published in September and December 2025 by the LCS. These reports indicate that for the current fiscal year, 2025-2026, the surplus will be zero. This means that when filing returns in 2027 for the 2026 tax year, it is very likely that there will be no TABOR refund, although analysts do not rule out its return in subsequent years.

Even a small surplus automatically triggers the lowest-priority distribution mechanism established by recent laws, such as SB21-233 of 2022, which was extended to 2035. This mechanism consists of a six-tiered refund credit based on the taxpayer’s federal Adjusted Gross Income (AGI).

The system, designed to comply with the constitutional mandate of “uniformity,” is non-progressive: it provides larger absolute amounts to those with higher incomes.

The amounts for 2026, based on the September 2025 forecasts and essentially confirmed by January, are as follows:

- For single filers:

- AGI up to approximately $56,000: $20.

- Intermediate levels with increasing amounts.

- AGI of $329,001 or more: $62.

- For joint returns (married filing jointly), the amounts are doubled:

- From $40 at the lowest tier, to $124 at the highest.

Who’s Eligible for the TABOR Refunds?

Eligibility is broad, but there are strict residency requirements. To qualify, an individual must have been a full-time resident of Colorado for the entire 2025 calendar year, be at least 18 years old by December 31, 2025, and, crucially, file a 2025 state income tax return (Form DR 0104), even if their income was zero, or they are not required to file. The amount is automatically calculated and included in the return. The deadline to file and claim is April 15, 2026.

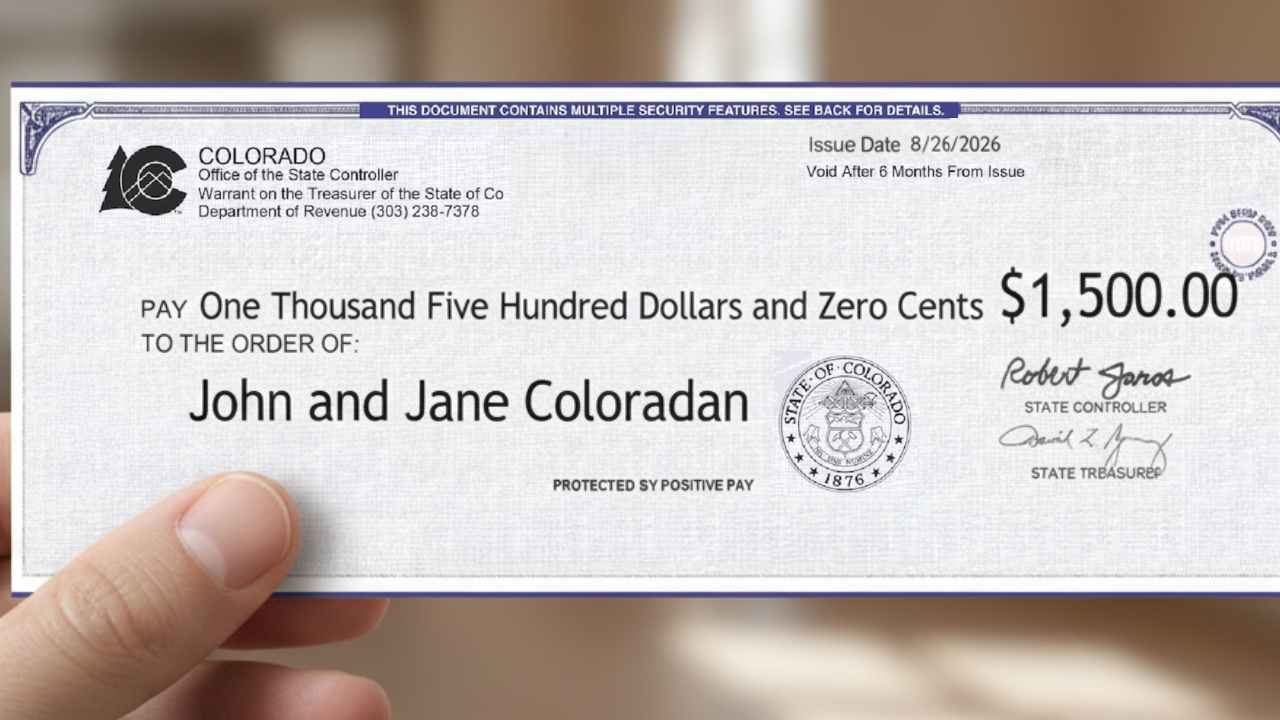

The refund will not arrive as a separate check. It will be applied as a credit within the normal tax filing process, increasing your total refund or reducing your balance due to the state. Most payments will be made by direct deposit or check throughout the spring and summer of 2026.