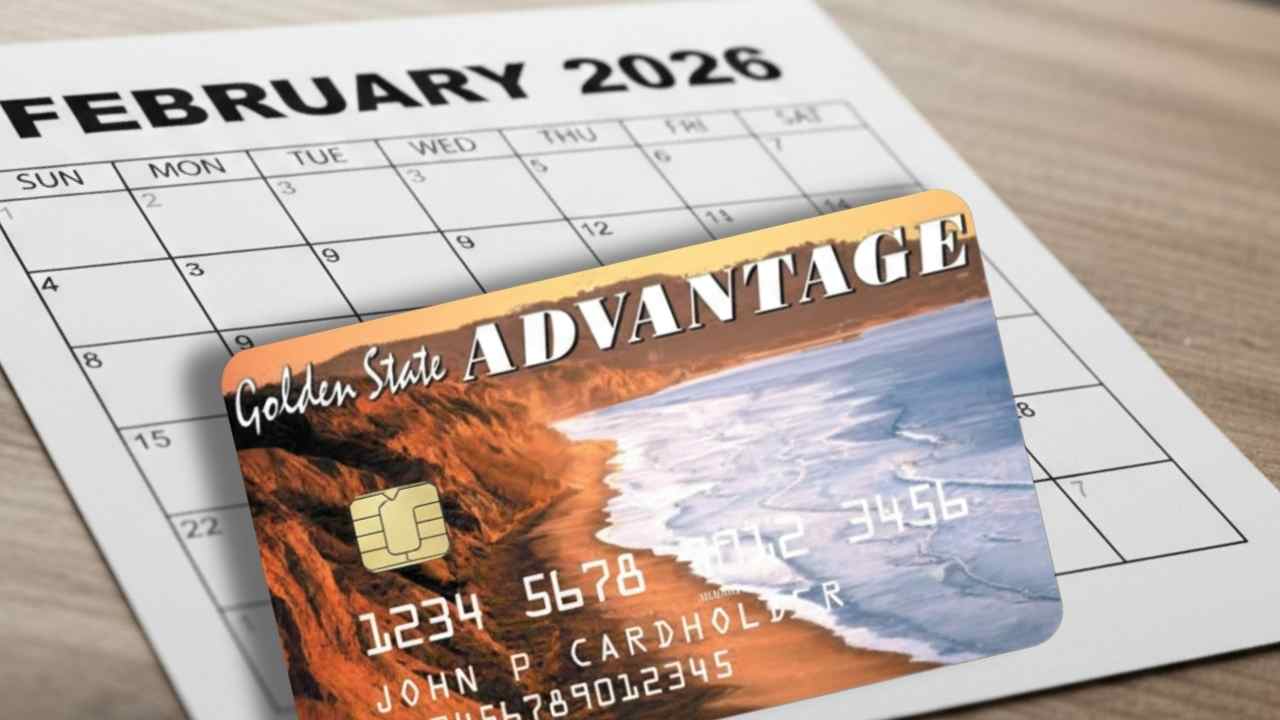

The benefits of the CalFresh program, corresponding to the month of February 2026, will be deposited into the Electronic Benefits Transfer Card accounts between the first and tenth of the month, with the first payments having already started on the 1st of this month.

The distribution follows a monthly schedule based on the last digit of each beneficiary’s assigned case number. This distribution method is used by the state of California to administer nutritional assistance payments, part of the federal Supplemental Nutrition Assistance Program (SNAP).

These Are the CalFresh Dates for February

- Last digit 1: February 1

- Last digit 2: February 2

- Last digit 3: February 3

- Last digit 4: February 4

- Last digit 5: February 5

- Last digit 6: February 6

- Last digit 7: February 7

- Last digit 8: February 8

- Last digit 9: February 9

- Last digit 0: February 10

Those who receive CalWorks have a different payment schedule. If you are in this group, contact your administering agency to find out exactly when you will receive your next payment.

Maximum SNAP Benefits Amounts

The maximum benefit amounts for households participating in CalFresh are determined at the federal level and adjusted annually. These amounts, effective from October 2025 through September 2026, reflect changes to the Thrifty Food Plan and cost-of-living adjustments.

For a one-person household, the maximum monthly benefit is $298. A two-person household can receive up to $546. Three-person households have a maximum of $785, and four-person households $994.

A five-person household has a limit of $1,183, and a six-person household $1,421. For seven people, the amount is $1,571, and for eight people, $1,789. For each additional member beyond eight, $218 is added to the household’s maximum amount.

OBBBA Law Changes Over the SNAP Payments

The One Big Beautiful Bill Act (OBBBA), designated as P.L. 119-21, was enacted in July 2025. This federal budget law contains several provisions that alter the structure and administration of the SNAP program, directly impacting its state implementation as CalFresh. The changes affect everything from the calculation of benefits to eligibility requirements.

A substantial change concerns the reassessment of the Thrifty Food Plan. The law alters the future methodology for reassessing this plan, which is the basis for calculating benefit amounts. The new provision limits significant increases that could result from such reassessments before October 1, 2027. This change may impact the rate at which benefits are adjusted in relation to food price inflation.

Changes for the ABAWDs Recipients

Another change is that the rules for Able-Bodied Adults Without Dependents (ABAWDs) have been expanded. Under the new provisions, individuals between the ages of 18 and 64 must document that they work or participate in a training or employment program for at least 80 hours per month.

This requirement is necessary to continue receiving benefits beyond the initial three months within a 36-month period, unless an exemption applies.

Changes were also made to the exceptions to the time limit rules. Under the new regulations, categories such as veterans, people experiencing homelessness, and young people leaving the foster care system are not automatically exempt from the time requirements and are subject to stricter criteria.