The wait is over for millions of taxpayers. The Internal Revenue Service (IRS) has officially kicked off the 2026 tax filing season, marking Monday, January 26, as the day it begins accepting and processing returns for the 2025 tax year.

This announcement marks the beginning of the period in which citizens must organize their documents, assess their situation, and, in numerous instances, await a possible tax refund. The window to fulfill this obligation without incurring penalties will close on Wednesday, April 15, 2026, the universal deadline for filing and payment.

The IRS Calendar Brings Changes and New Requirements

However, beyond the two key dates, this season brings significant changes to forms and procedures, along with the full implementation of regulations that will change the way Americans receive their money.

The period between January 26 and April 15 marks the 2026 tax season. Taxpayers who need more time to gather their information can request an extension by filing Form 4868. This request, which must be made by April 15, grants an automatic extension until October 15, 2026.

This extension applies only to filing the return, not to paying any taxes that may be owed; an estimate of the amount due must be paid by the original April deadline to avoid interest.

You Can No Longer Get Tax Refunds by Paper Check

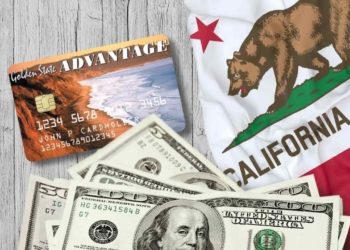

The biggest change in the process comes with how refunds are received. By mandate of a federal executive order aimed at modernizing government payments and increasing security, the IRS has permanently eliminated the mailing of paper refund checks.

From now on, direct deposit is the only way to receive any refunds from the agency. This makes it essential to have an active bank account, a prepaid debit card that allows these deposits, or a compatible digital wallet, and to ensure that the information provided on the return is accurate.

New Features in the Tax Form: Crypto, Tips and a New Schedule

The 2025 tax return introduces adjustments to the content of the forms to reflect changes in the economy and regulations. One of the most important changes is the treatment of digital assets, such as cryptocurrencies, stablecoins, or NFTs. The IRS has made it clear that all transactions involving these assets must be reported.

Taxpayers will find a specific question on this topic on the first page of Form 1040, and they must answer it truthfully, regardless of whether or not they have received the new Form 1099-DA from the exchange platforms.

The Introduction of the New Annex 1-A

This form will become the designated document for claiming certain deductions that were previously reported elsewhere, including new deductions related to tips not reported by the employer and car loan interest.

Additionally, those who use an Individual Taxpayer Identification Number (ITIN) should verify its validity: if an ITIN was not used on a federal return in the last three years (2022-2024), it is very likely that it expired on December 31, 2025, and requires a renewal process in order to file.

How to Prepare for a Smooth Tax Season

The key to a smooth tax season lies in preparation. Experts recommend, as a first step, gathering and organizing all financial documents: W-2 forms from employers, various 1099 forms (for self-employment income, interest, dividends, or, significantly this year, third-party payments such as those on Form 1099-K), and receipts that support deductions or credits.

For those who prefer or need assistance, the IRS and its partners offer several free programs. IRS Free File, active since January 9, guides income-qualified taxpayers through electronic tax preparation and filing at no cost. In-person assistance is available through the Voluntary Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs, which offer free help to low- and moderate-income individuals, those 60 and older, people with disabilities, and those with limited English proficiency.

Once you’ve filed your tax return electronically, the recurring question is: “Where’s my refund?” The official tool to answer this is “Where’s my refund?” on the website IRS.gov. The system typically updates the information approximately 24 hours after an electronic filing of a current year’s return. For those who file on paper, the wait can extend to four weeks before the information is available online.

Although the IRS promises to issue the vast majority of refunds via direct deposit in less than 21 days, this timeframe only begins once the return is accepted, provided it is error-free, complete, and not selected for further review.