What are COLAs? Cost-of-living adjustments, COLAs, are familiar yearly increases that are given to Social Security benefits and programs such as retirement, Supplemental Security Income (SSI), and payments for disabled workers, known as SSDI.

Their main goal is to offset the decrease in buying power that Social Security beneficiaries see because of inflation. These increments are automatic and affect more than 72.5 million people in the country.

How is the COLA percentage established?

The COLA percentage is based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers, also known as CPI-W, a figure published monthly by the Bureau of Labor Statistics (BLS).

The process involves comparing the average CPI W for the third quarter July, August, and September of the current year with the average for the same months of the previous year. The percentage increase that results is the COLA for the following year.

How much was the Social Security COLA in 2025?

This procedure was set in 1975 as a consequence of the Social Security Amendments Act of 1972. The social security COLA is usually announced in October but it could be delayed.

The COLA for fiscal year 2025 was set at 2.5%. This triggered an increase in the amounts of Social Security checks that started in January 2025 and in the SSI payments that began on December 31, 2024. As a result, the average monthly retirement benefit went from approximately $1,907 to $1,948.

This was an increase of nearly 41 a month for the average beneficiary. This 2.5% adjustment showed a less intense trend than the increases in the immediately previous years, which were marked by inflation spikes in the post pandemic. The percentage for 2025 was a slowdown in inflation rates.

The Social Security taxable income this year

At the same time, the maximum amount of income subject to Social Security tax in 2025 was set at $176,100. The official announcement of the adjustment is made by the Social Security Administration SSA around mid October.

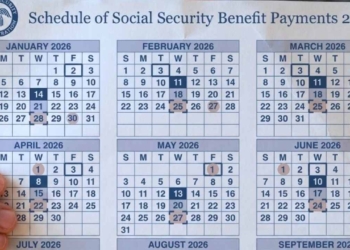

The new percentage is applied to the January payments of the following year for the social security beneficiaries and to the December payment of the current year for SSI recipients, while, the new maximum taxable income will be set following that COLA increase.

The Government shutdown could delay the COLA 2026

As of today, the Congress of the United States faces an imminent threat of a partial shutdown of the federal government. This stems from disagreements over the approval of funding legislation for the government. An event of this type could directly impact the announcement of the COLA for 2026, which is scheduled for October 15, 2025.

The reasons for the delay are operational. The final calculation of the COLA depends critically on the publication of the data of the CPI-W for September 2025, which the BLS is scheduled to publish on October 10.

In a shutdown scenario, the BLS would suspend most of its activities that are considered non essential and this could lead to a postponement of the publication of these key figures. The SSA needs these figures to finalize the calculations and proceed with the official announcement.

Even a short closure, lasting just a few days, could force the announcement to be postponed beyond the originally scheduled date of October 15. This would generate uncertainty for millions of beneficiaries who depend on this information for their annual planning of the budget.

COLA projections increase by 2026 from TSCL and others

Even though the general recommendation is to wait for the official SSA announcement, to confirm the exact percentage, the Senior Citizens League (TSCL), an advocacy group for retirees, projects a COLA of 2.7% for 2026.

This projection, slightly higher than the 2.5% in 2025, is based on a 2.7% rise in the CPI W in the third quarter. If realized, this increase would translate into an average monthly raise of approximately 52 for a typical pensioner whose pension is worth $1,948.

TSCL has held this estimate steady but warns that the September figures could slightly adjust it. For its part, the AARP, the American Association of Retired Persons, estimates a modest adjustment, also around 2.7%, in line with a preliminary CPI W of 2.8% through August.

Other sources, including independent analysts cited in financial media, agree in projecting a COLA within a range of 2.5 to 2.8%.

In a baseline scenario, this would represent an extra $59 a month for the average beneficiary, but this is just an estimation, not the definitive calculation that, once again, depends entirely on the numbers from the SSA.

The AARP reiterates that although inflation headline has shown signs of stabilizing, volatile factors such as energy prices could have a decisive influence on the final estimate.