Amid growing tension over the partial shutdown of the U.S. federal government, which threatens to become the longest in modern history, some good news is bringing relief to more than 70 million beneficiaries: Social Security funds are protected, and benefit payments will not be delayed.

Unlike other federal services affected by the lack of budget approval, the Social Security Administration (SSA) program operates with independent resources from dedicated contributions by workers and employers, accumulated in special trusts that are not subject to the annual discretion of Congress.

Social Security Unaffected by Longest Shutdown in Years

“You will continue to receive your payments on time,” the SSA assured in an official statement issued in early October, underlining that although thousands of federal employees have been furloughed, automated systems guarantee the continuity of payments.

This government shutdown, now in its third week and having left hundreds of thousands of federal workers—including air traffic controllers and national park employees—without paychecks, does not impact the foundations of Social Security.

Experts point out that in previous shutdowns, such as the one in 2018-2019, checks arrived on time, thanks to the program’s legal structure that prioritizes these essential payments over any political contingencies.

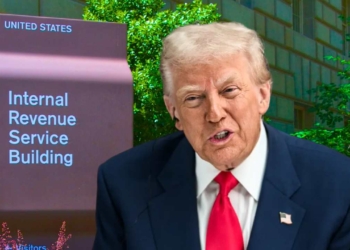

With President Donald Trump warning that he will not yield to Democratic “blackmail” in Congress, and Senate Majority Leader John Thune expressing optimism about a deal this week, uncertainty persists. However, for retirees, the disabled, and families dependent on these payments, the message is clear: the social safety net is not breaking down.

Payment Dates Confirmed for November: Nothing Changes

For those who began receiving benefits after May 1997 – the majority of current beneficiaries – the November 2025 payment schedule remains unchanged, aligned with the second, third, and fourth Wednesdays of the month, according to the beneficiary’s date of birth:

- November 12 (second Wednesday): For birthdays from the 1st to the 10th of the month.

- November 19 (third Wednesday): For birthdays from the 11th to the 20th.

- November 26 (fourth Wednesday): For birthdays from the 21st to the 31st.

These electronic deposits are made directly into designated bank accounts, or by mail a few days earlier for those who haven’t opted for direct transfer. Supplemental Security Income (SSI) recipients already received their November payment on October 31, which was paid early because November 1 fell on a Saturday. The SSA urges recipients to check their account status at mySocialSecurity.gov to avoid any surprises.

Maximum Amounts: Stability in 2025, with Adjustment to the Wind

In November, benefits remain at 2025 levels, with no monthly changes. The maximum amount for a retiree who reaches full retirement age (FRA, 67 for most) is $4,018per month. For those who choose to retire early at age 62, the cap is $2,831. On average, retirees receive around $2,008 monthly, but these ceilings represent the potential for those who have contributed the maximum for 35 years.

Looking ahead, the Cost of Living Adjustment (COLA) for 2026 brings some relief: an increase in the 2.8%, announced on October 24 by the SSA. This adjustment, which reflects accumulated inflation, will automatically take effect on January 1, 2026 for almost all beneficiaries.

For the maximum FRA payment , this means an increase of approximately $113 raising the limit to about $4,131 monthly. Personalized notification letters will arrive by mail in December, but estimates can already be viewed online.