If you’re a taxpayer in Colorado, welcome to the world of the Taxpayer’s Bill of Rights (TABOR), the state’s constitutional gem that transforms tax surpluses into real relief for families, retirees, and everyday dreamers.

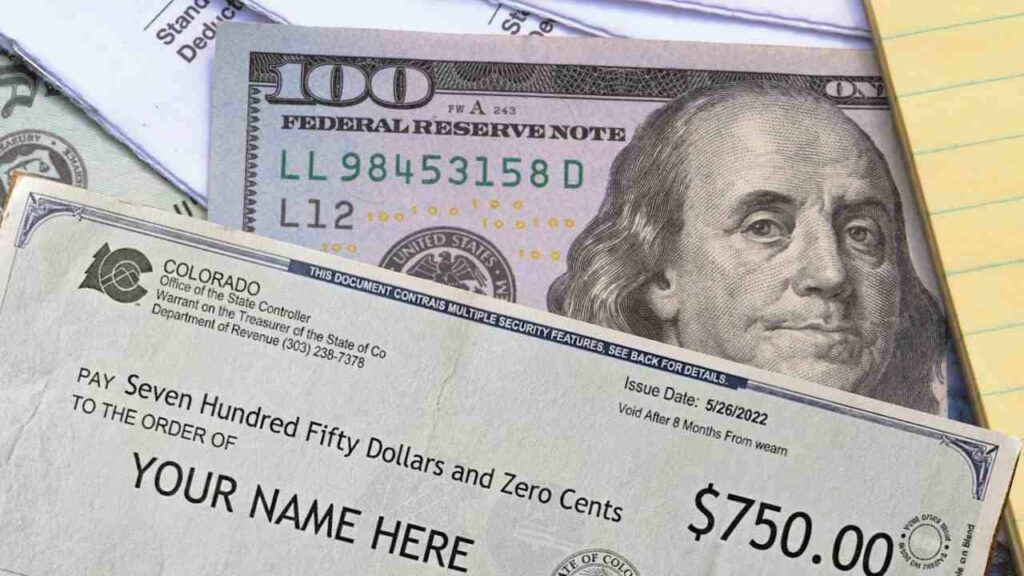

In 2025, with a state surplus of over $2 billion, Colorado is sending tax refund checks between $177 and $1,130 in the coming days, because in Colorado, the government doesn’t hold onto your money; it gives it back with grateful interest.

Colorado TABOR Refund 2025: Who Gets Up to $1,130?

The Taxpayer’s Bill of Rights (TABOR) is one of the most innovative and controversial tax mechanisms in the United States. Approved by Colorado voters in 1992 through Amendment 1 to the state constitution, TABOR limits government revenue growth to inflation plus population growth.

If the state generates a tax surplus—that is, collects more than allowed—this “extra money” must be returned to taxpayers in the form of refunds, tax rate reductions, or tax credits.

This principle aims to prevent the government from accumulating unnecessary funds and promote fiscal responsibility, although it has been criticized for restricting investment in education, health, and infrastructure during periods of economic growth.

$2 Billion Surplus Leads to Major Tax Refund Checks

In 2025, Colorado is distributing one of the most generous TABOR refunds in its history, thanks to a projected tax surplus of more than $2 billion for fiscal year 2024.

The payments, which range from $177 to $1,130 per taxpayer, began being distributed in October 2025 and will continue through the end of November, with ongoing processing based on the order in which returns are filed.

Unlike federal stimulus checks, these funds come directly from excess state taxes, and their total amount for 2025 exceeds $1.9 billion, positively impacting approximately 3.5 million households.

Eligibility Criteria for the TABOR Refunds

To receive the 2025 TABOR refund, you must meet strict residency and tax filing criteria. First, you must be a full-time Colorado resident for the entire year of 2024—that is, have lived in the state for at least 12 months, without any extended absences that would affect your tax status.

Additionally, you must be at least 18 years old as of January 1, 2024. There is no minimum income requirement, but the amounts vary based on your adjusted gross income (AGI) reported on your 2024 federal tax return.

The primary goal is to have filed your 2024 Colorado individual income tax return (Form DR 0104) by April 15, 2025. If you didn’t file taxes because your income was low or zero, you may still qualify by applying for the Property Tax/Rent/Heat Credit Rebate (PTCRE).

This alternative program allows low-income individuals, especially seniors (age 65 and older) or people with disabilities, to claim a refund without filing a full tax return. The PTCRE application must have been filed by June 30, 2026, but to maximize your chances of receiving payment in 2025, apply as soon as possible.

Note: Partial nonresidents, prison inmates, or people with outstanding tax debts do not qualify.

Reimbursement Amounts: Scale Based on Income and Marital Status

The amounts are not fixed; they are calculated on a progressive scale that favors higher-income households, but with a cap to ensure fairness. The DOR announced the details on October 17, 2024, based on state revenue projections. Here is a breakdown by adjusted gross income (AGI) bracket and filing status:

| Adjusted Gross Income Range (AGI) | Single | Joint (Marriage or Civil Partnership) |

| Up to $53,000 | $177 | $354 |

| $53,001 – $105,000 | $240 | $480 |

| $105,001 – $166,000 | $277 | $554 |

| $166,001 – $233,000 | $323 | $646 |

| $233,001 – $302,000 | $350 | $700 |

| $302,001 or more | $565 | $1,130 |

A Practical Example

For example, a single person with an income of $40,000 would receive $177, while a married couple with $400,000 would each receive $1,130 (totaling $2,260 for the household). These amounts represent approximately 4-5% of the state surplus prorated per taxpayer.

For PTCRE applicants, especially seniors age 65 and older, the reimbursement is a fixed $1,130 per person, regardless of income, as long as they meet the program’s eligibility limits (generally annual income below $18,000 for singles or $24,000 for couples). This provides vital relief for retirees on fixed incomes, covering costs such as heating or rent.

How to Claim and Receive Payments

If you filed your 2024 tax return with direct deposit, your refund will be issued electronically 4-6 weeks after processing. Otherwise, you will receive a check in the mail. The DOR processes returns in the order they are received, so those filed early (January-February 2025) have been receiving payments since early October.

As of November 24, 2025, distribution is in full swing, with most refunds completed by the end of the month. If you haven’t received anything by December, check your status at Revenue Online (revenueonline.colorado.gov) using your Social Security number.

For non-filers, download Form DR 0104PTCRE from the DOR website and submit it by mail or online. Include proof of residency, such as utility bills or rental agreements. Beware of scams: The DOR does not charge for processing refunds or request upfront payments by phone or email.