50 is the kind of age that makes retirement feel real in a way it simply didn’t before. The vague plan you told yourself you’d figure out later starts demanding actual numbers. And those numbers have a way of being either reassuring or uncomfortable. For most workers, the honest answer falls somewhere in between: not a disaster, but not quite on track either.

One benchmark that financial planners have leaned on for years puts the target at 6 times your annual salary by the time you hit 50. That figure isn’t pulled from thin air. It reflects decades of data on investment growth, average life expectancy, and what people realistically spend once they stop working. It won’t fit every situation perfectly, but it gives you a starting point — Which, at 50, is exactly what you need.

The Retirement Savings Number Most 50-Year-Olds Are Missing

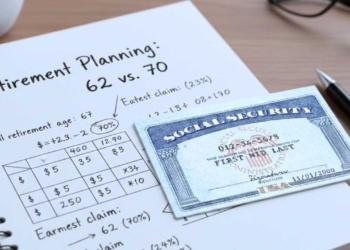

Based on the most recent available data, the average American worker earned $1,204 per week in 2025, according to figures from the Bureau of Labor Statistics. That equates to $62,608 annually. Applying a multiplier of six, the resulting savings target for a 50-year-old man is $375,648.

The figure above, however, contrasts sharply with the actual savings behavior of people in that age group. According to Federal Reserve data from 2022, the median retirement account balance for people aged 45 to 54 was just $115,000. That represents less than a third of the theoretical target based on average wages.

Are You Behind on Retirement Savings at 50?

The difference between these two figures—$375,648 versus $115,000—illustrates a structural gap in the savings behavior of American workers. The reasons for this deficit are varied: career breaks, financial burdens related to housing or education, and a lack of systematic savings strategies in previous years.

However, analysts point out that reaching 50 with a balance below the target does not mean the situation is beyond repair. The last decade of working life often encompasses the years of highest income, opening a window of opportunity to accelerate capital accumulation if concrete measures are taken.

The Retirement Catch-Up Contributions

One of these mechanisms is the so-called catch-up contribution, which the U.S. tax system allows starting at age 50. This tool enables workers to increase their annual contributions above the standard limits. In 2026, this advantage translates into the possibility of allocating up to an additional $1,100 to an IRA, and between $8,000 and $11,250 extra to a 401(k) plan.

At the same time, experts recommend avoiding early withdrawals from retirement accounts, a practice that reduces available capital and generates tax penalties that further erode the accumulated balance. Keeping deposited funds intact and making regular contributions are two actions that, combined with the effect of compound interest, can significantly alter the outlook before retirement.

You Have 15 Years Until Retirement: What You Can Do

The time remaining between age 50 and the typical retirement age—which in the United States is around 65—allows investments to continue generating returns. This factor is crucial: a well-structured investment portfolio can more than double in value during that period, depending on the instruments chosen and market conditions.

If the gap feels too wide to close by your original target date, working a few extra years is worth putting on the table. It’s not the answer anyone gets excited about, but it pulls in two directions at once — you keep adding to your savings while also shortening the stretch of retirement you’ll need to fund. That combination can move the numbers more than most people expect.

Beyond the math, though, retirement planning at this stage gets personal in ways that general rules can’t really account for. Your health outlook, whether you’ll lean heavily on Social Security, any rental income or investments that pay without you working, and how much you actually plan to spend once you stop — all of that shapes what your real target should look like.

Two people with identical salaries and identical balances at 50 can have extremely diverse roads ahead, depending on those details. That’s what makes this stage less about hitting a universal benchmark and more about building a plan that actually fits your life.