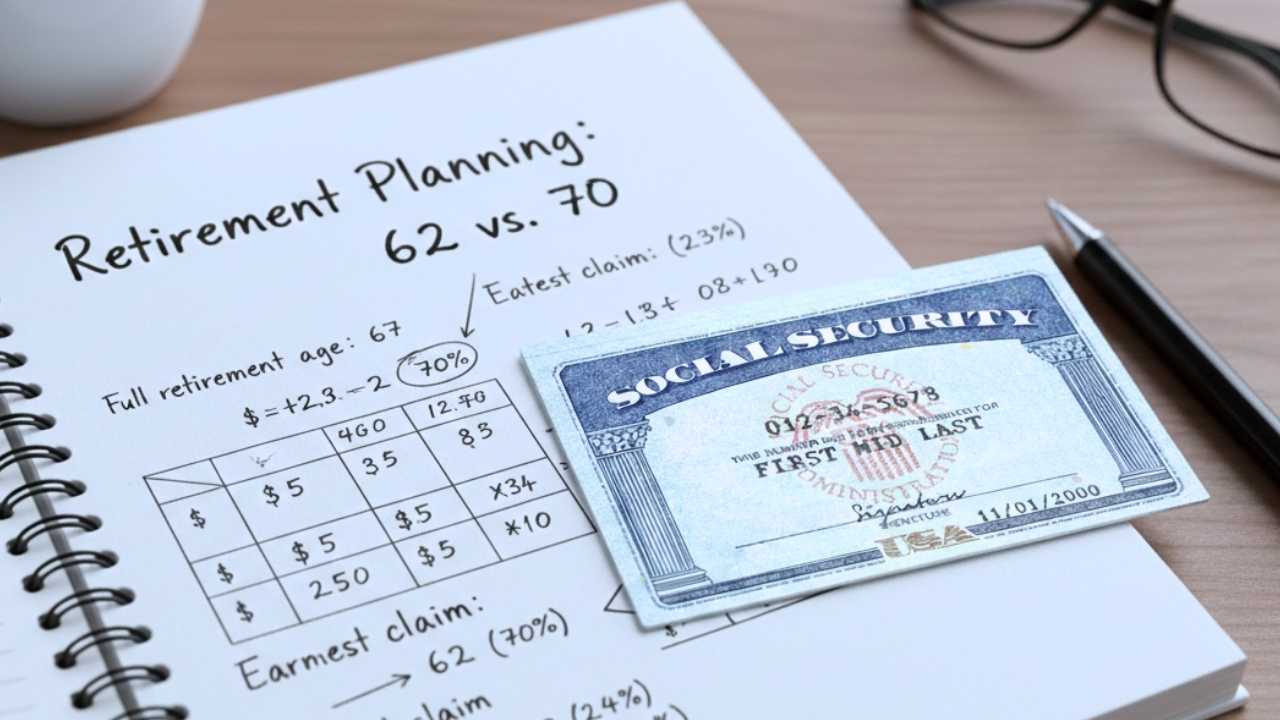

The Social Security system allows you to claim retirement benefits from age 62, but the full retirement age (FRA) for those born in 1960 or later is 67. Those who wait until age 70 receive the maximum possible benefit.

There’s a decision millions of Americans make every year without fully calculating the cost: to collect Social Security as soon as they’re eligible, at age 62. The logic seems reasonable: I’ve worked my whole life; it’s time, why wait? The problem is that this impatience comes at a very specific price, measured in thousands of dollars lost each year, right up until the day they die.

What Happens to Your Social Security Check If You Claim Early

Social Security is designed with a fairly straightforward actuarial principle that states that the earlier you start receiving benefits, the less you receive per month, permanently. The full retirement age for those born in 1960 or later is 67.

If you retire at age 62, your monthly benefit is reduced by approximately 30% compared to what you would receive at 67. And if you wait until 70, your benefit increases by an additional 8% for each year beyond 67, reaching around 24% higher than the full benefit.

Put another way: the difference between receiving benefits at 62 and receiving them at 70 can exceed 76% in the monthly amount.

Retiring Early Sounds Smart: Social Security’s Math Says Otherwise

To understand that in real dollars, just look at the numbers for the average worker. Statistics say that someone who claims their benefits at age 62 receives around $1,341 a month. Someone who waits until age 70 receives about $2,148. That’s $807 less per month for the one who rushed in, which translates to approximately $9,678 less per year.

And that’s not a one-time event: it’s a difference that repeats itself every year for as long as the person lives. If they live to 85, that early decision will have cost them, cumulatively, more than $120,000.

The Real Cost of Claiming Social Security Before You Should

For those who earned higher salaries and contributed the maximum amount during their working lives, the gap is even more dramatic. In 2026, the maximum possible benefit at age 62 is $2,969 per month, while at age 70 it reaches $5,181. That’s a difference of $2,212 per month, or $26,544 per year. In this case, a decade of life beyond the break-even point can mean losing more than a quarter of a million dollars in accumulated benefits.

There’s another effect that few people consider: annual cost-of-living adjustments, known as COLAs. Every time inflation pushes benefits up, that increase is calculated as a percentage of the base benefit. Those who started with lower benefits continue to receive smaller increases in absolute terms, year after year, causing the gap between those who started early and those who waited to widen over time instead of remaining stable.

Your Spouse Could Pay the Price for Claiming Social Security Too Early

This is compounded by the impact on spouses. If the beneficiary dies first, the survivor is entitled to inherit that benefit as a widow’s/widower’s pension. A reduced amount due to early retirement then becomes a financial burden that falls not only on the person who made the decision but also on their spouse.

The only real argument in favor of retiring at 62 is that you start receiving pension checks eight years earlier than someone who waits until 70. There’s a point of equilibrium, generally around 80 to 82 years old, up to which the person who started receiving checks earlier has accumulated more money overall. But those who retire past that age—and today in the United States there are tens of millions of people doing so—end up better off having waited.