President Donald Trump has repeatedly made a promise in multiple forums that has captured public attention: the issuance of $2,000 stimulus checks to citizens, funded exclusively by revenue generated from trade tariffs.

“Are we really getting another $2,000 stimulus check in 2025?” is a question circulating on various platforms. The official narrative presents this measure as a direct dividend of trade policy.

The discourse focuses on returning a supposed surplus to the public. However, the implementation of this initiative depends on multiple economic and political factors that require examination.

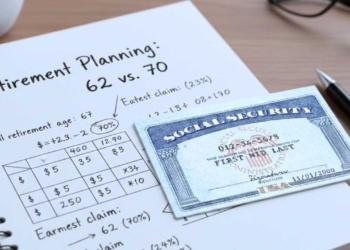

Trump’s stimulus checks: Where did the $2,000 proposal come from?

The idea was formalized in statements during the third quarter of 2025. Trump has described tariffs on imports from various nations as a monumental source of revenue for the US Treasury.

In a meeting with his cabinet in early December, the president specified: “Next year will be the biggest tax refund season in history, and we’re going to be returning tariff refunds… a nice dividend for the people, as well as reducing the debt.”

The idea continues with the following argument: funds raised through tariffs on imported goods would be redirected, without congressional approval, to direct payments. This approach evokes previous resource transfer programs, but with a novel source of funding.

Who would be eligible for tariff stimulus checks?

The eligibility criteria remain in a zone of deliberate ambiguity. Presidential statements have indicated that the beneficiaries would be individuals of moderate and middle income, expressly excluding high-net-worth individuals.

As of today, there are no official documents defining income thresholds, payment frequency, or the eligible beneficiary unit (household or individual). Treasury Secretary Scott Bessent qualified the proposal, indicating that it would provide relief for “working families.” In his remarks, Bessent added a note of caution: “We’ll see if that materializes,” suggesting that the process is far from guaranteed.

Tentative chronology of payment distribution

The proposed distribution schedule has undergone several adjustments since these payments were first discussed in the White House. Initially, Trump mentioned the possibility of a disbursement by the middle of next year. He later clarified that the event would occur “probably in the middle of next year, a little bit after that.”

This timeline places the potential distribution in the second or third quarter of 2026. The president has explicitly linked the measure to a political context, ruling out any implementation in the short term: “It won’t be this year.” This statement eliminates the possibility of economic stimulus during the 2025 holiday season. The Internal Revenue Service (IRS) has not issued any statement related to this program.

Remembering the “pandemic” stimulus checks

The precedent for massive direct payments dates back to the pandemic relief checks, a program that has since ended. The promise of “thousands of dollars for moderate-income individuals” seeks to revive that collective memory.

However, the lack of a detailed roadmap from executive agencies keeps the proposal in the realm of speculation. Analysts have asserted that the mentioned timeframe would coincide with the pre-midterm election cycle, adding a political dimension to the analysis.

How much has the federal government collected from tariffs?

According to analysis by the Tax Foundation, tax revenue in 2025 is projected to reach approximately $200 billion. While this represents a significant increase compared to previous years, the amount falls far short of the “trillion” figure mentioned. A simple calculation shows that distributing $2,000 among tens of millions of households would consume a substantial portion of that revenue.

The economic impact of tariffs is also measured on the consumption side. Studies by institutions such as Yale University estimate that trade tariffs have increased costs for American households by between $1,800 and $3,800 annually, due to higher prices for imported goods and locally produced goods that use taxed inputs.

In this scenario, the proposed dividend could be interpreted as partial compensation for these higher expenses previously incurred by consumers. The net result for household finances would not necessarily be a gain.