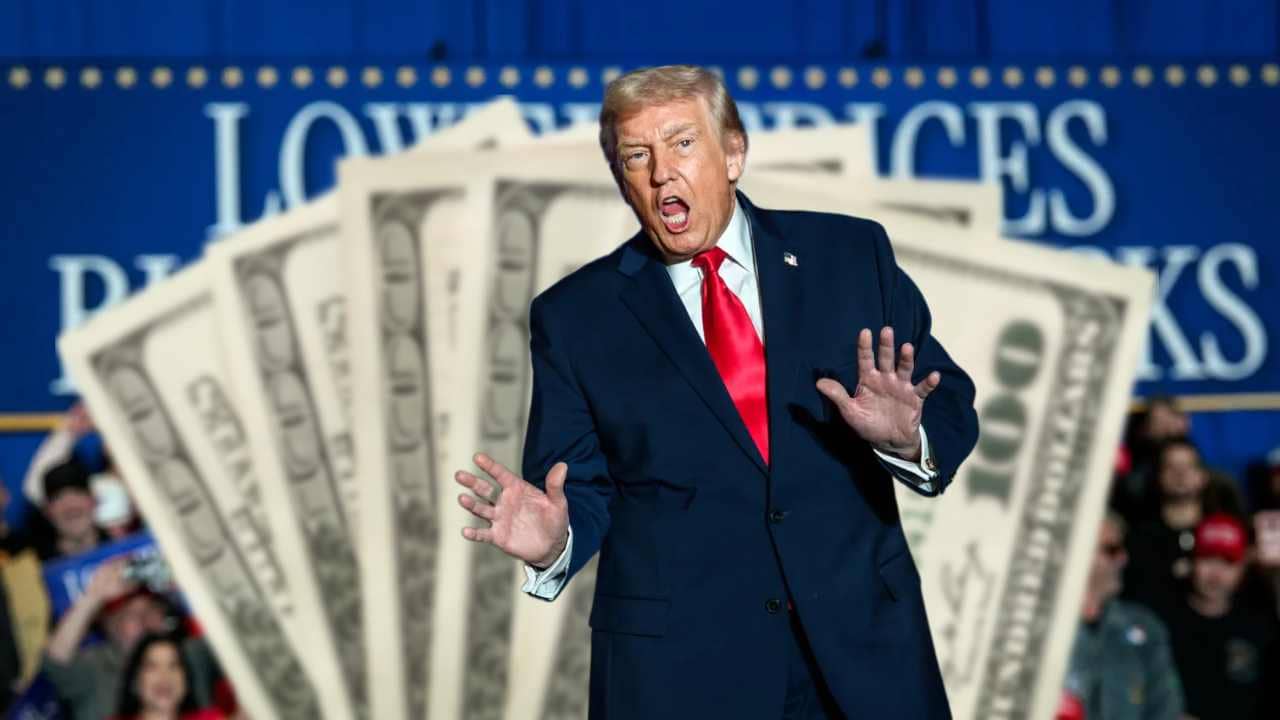

In a move already resonating in the lead-up to the 2026 election, former president and candidate Donald Trump has promised to send Americans “tariff dividend” stimulus checks of at least $2,000. The announcement, delivered with his characteristic self-assurance, projects a direct injection of money into taxpayers’ pockets “probably by the middle of next year.”

However, a closer examination of the stimulus checks proposal shows a gaping chasm between political rhetoric and economic, legal, and budgetary reality. What is being sold as a simple rebate of taxes paid by other countries faces a wall of numbers that don’t add up, pending constitutional challenges, and the stark necessity of a political agreement in a Congress that may be unwilling to deliver.

Trump’s $2,000 “Tariff Dividend” Checks

The promise is simple and powerfully appealing: to return to citizens a “fair share” of the billions of dollars raised through tariffs imposed on foreign imports during his administration.

Under the framework outlined by Trump and his Treasury Secretary, Scott Bessent, these “tariff dividends” would take the form of direct checks, temporary tax relief, or tax cuts, with a minimum value of $2,000 per person.

Bessent has hinted at the possibility of an income cap, perhaps excluding households earning more than $100,000 annually, though he admits that all the details “are being discussed.” The timeline points to 2026, an election year laden with symbolism.

Fact Check: Can Trump’s $2,000 Stimulus Checks Really Happen in 2026?

This is where the promise encounters its first and most formidable obstacle: basic arithmetic. The proposal rests on the idea that there is a tariff revenue surplus large enough to fund generous checks for hundreds of millions of Americans. Official data disproves this premise.

According to Treasury figures, from January to November 2025, the federal government collected $236.2 billion in tariff revenue. A colossal sum, undoubtedly, but one that pales in comparison to the estimated cost of the proposal.

Independent economic analyses calculate that sending $2,000 checks only to low- and middle-income adults would cost at least $300 billion. If the entire population, including children, were included, the bill would skyrocket to $600 billion.

In short, current annual revenues aren’t even enough to cover the most restrictive version of the plan. And this ignores a crucial fact: that money isn’t just sitting idle in a bank account. The government is already spending it. In December 2025, the administration announced a $12 billion aid package for farmers affected by the trade wars, funded precisely by these tariffs. Furthermore, the Trump team itself has stated on other occasions that it intends to use tariff revenues to reduce the national debt. The same dollar can’t pay three different bills.

Supreme Court Holds Key to Trump’s Proposed 2026 Stimulus Checks

Beyond the financial aspect, the promise hangs by a legal thread. The administration’s very authority to impose many of the tariffs that generate this revenue is being challenged before the U.S. Supreme Court. Several cases, brought by importers and trade groups, argue that the administration exceeded its executive authority by imposing these levies without explicit congressional approval.

A ruling against the government would not be a mere procedural setback. It could force the administration to return billions of dollars already collected from importing companies.

This scenario, which legal experts consider plausible, would instantly wipe out the supposed financial cushion for the checks. Even if the court rules in favor of the administration, the legal uncertainty freezes any serious planning until the matter is resolved, which might not happen before 2026.