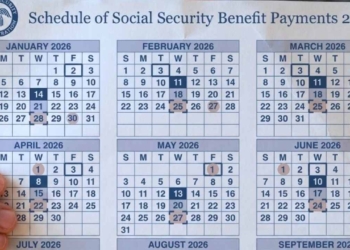

Amid a tense partial federal government shutdown that has paralyzed several key agencies, the Social Security Administration SSA has confirmed a new date for the 2026 cost-of-living adjustment (COLA) announcement : October 24. Originally slated for October 15, the delay is attributed to the Bureau of Labor Statistics (BLS) failure to release the September Consumer Price Index for Urban Wage Earners (CPI-W) report, which is necessary for calculating the adjustment.

This unexpected event underscores administrative weaknesses at a time when millions of retirees rely on these benefits for their daily lives. The COLA increase, an automatic mechanism meant to counter inflation, will impact more than 72.5 million Social Security and Supplemental Security Income recipients in the United States. Introduced every January since 1975, the adjustment is based on the average CPI W from July through September of the prior year.

What to expect from the 2026 Social Security COLA increase

For 2025, the COLA was 2.5%, a modest uptick that bumped the average monthly benefit to 1,865 for all recipients and 2,008 for retirees. But with the economy showing signs of slowing down inflation below 3 and Federal Reserve interest rates falling, expectations for 2026 point to a similar, albeit slightly higher, adjustment.

The Senior Citizens League (TSCL), a nonpartisan interest group based in Virginia, has projected a 2.7% COLA for next year, using a proprietary machine learning model updated in January 2025. This algorithm considers not only the CPI-W, but also the national unemployment rate and federal interest rates, conforming to the federal fiscal year for accuracy.

While a relief, this boost may not be enough to offset the continued erosion of purchasing power, the organization warns in its monthly COLA Watch report. In concrete terms, the impact on maximum payments illustrates the magnitude of the change. By 2025, the maximum monthly benefit for those claiming at age 70 after having contributed to the salary cap of $176,100 for 35 years is $5,108.

With the projected 2.7% increase, this amount would climb to about $5,246 in 2026. Likewise, the maximum at full retirement age FRA, between 66 and 67 depending on the year of birth, would rise from the current $4,018 to about $4,128.

The Social Security COLA could be not enough

However, the TSCL specifies that the current system is structurally flawed. Since 2010, the purchasing power of the average benefit has fallen by 20% because the CPI-W does not accurately reflect seniors’ expenses, such as housing and healthcare, which have risen more rapidly.

The organization proposes alternatives such as the Consumer Price Index for the Elderly (CPI-E), which over the past 10 years has generated average COLAs of 3.0%, higher than the 2.8% of the CPI-W. Even more ambitious is the TSCL’s CPI-BEST, which guarantees a minimum of 3.0% or the higher of the CPI-W and CPI-E if inflation exceeds it, averaging 4.0% over the past decade. For a hypothetical benefit of $2,000, this change could add up to more than $19,000 more over 10 years.

As October 24 approaches, attention is focused on the CPI-W report. If the TSCL’s projections materialize, the 2.7% rate will offer some relief, but not a solution to the growing discontent over the gap between actual inflation and official adjustments. The TSCL urges Congress to reform the calculation index before the Social Security deficit—projected to deplete reserves by 2035—further complicates the outlook. For many, this is not just a number: it is the difference between stability and precariousness in old age.