With the arrival of the new year, a ritual as Alaskan as the Northern Lights or the midnight sun is set in motion once again. It’s not a holiday, but an administrative process that, nevertheless, sets the economic pulse for thousands of households: the application window for the Permanent Fund Dividend (PFD) stimulus checks.

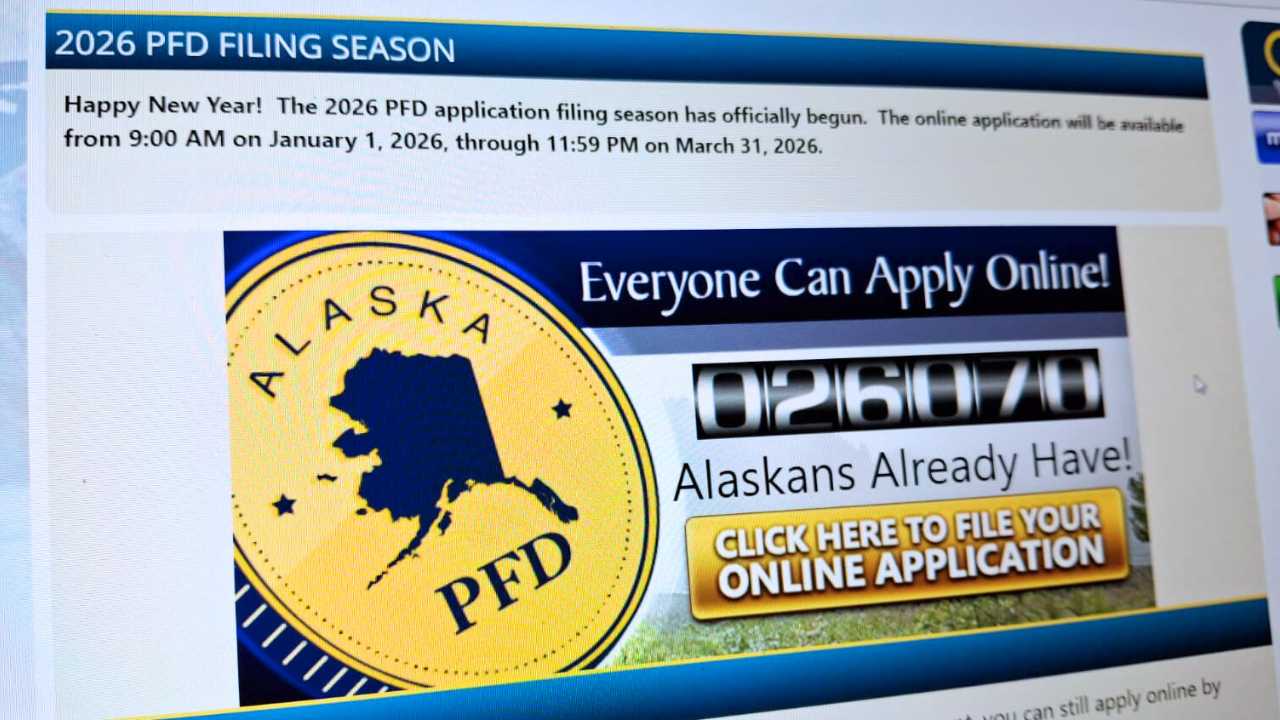

From the first minute of January 1st, the portal pfd.alaska.gov became the digital epicenter of the financial hopes of residents across the state. Until March 31, eligible Alaskans are tasked with claiming their share of the nation’s most unique sovereign wealth fund, a four-decade-long stimulus checks program that turns non-renewable oil wealth into an annual check for the people.

Alaska’s Annual Stimulus Check: Who’s Eligible

This payment, often mistakenly equated with a federal “stimulus” because of its immediate effect on household finances, is actually a symbol of national identity and economic security. Established in 1976 by a constitutional amendment, the Permanent Fund captures a percentage of the state’s oil revenues for future generations.

The 2026 election, based on residency throughout 2025, is a strict filter. The state requires physical presence with the intention of remaining, allowing only limited and justified absences. Claiming residency elsewhere or having certain criminal convictions disqualifies the applicant.

The process, now entirely digital (and requiring JavaScript), is a gateway that must be crossed on time. The unofficial recommendation is to apply early; the system, known for becoming congested near the deadline, can be the difference between timely payment and a long wait.

Dates for the PFD Stimulus Payments Program

The Alaska Department of Revenue will process applications through the summer, but the final amount won’t be known until the state Legislature, amid its budget debates, approves the distribution. Historical patterns suggest announcements in September, with payments beginning in October.

However, the schedule for outstanding payments from previous years is already set: three key dates in January, February, and March will close the books for the 2025 PFD.

$1,000 or $1,700? What Your Next PFD Really Depends On

The true barometer of the program lies in its recent history, a sequence that narrates the tension between public expectations and fiscal reality.

In 2023, the dividend was $1,312. It was seen as a modest payout, but it came at a time of national inflationary pressures, providing a relief for essential expenses. Its distribution in the fall injected capital into local economies just before the harsh winter.

2024 brought a significant increase to $1,702. This amount explicitly incorporated an “energy relief component” of $298, a direct acknowledgment of the state’s soaring heating and electricity costs. It was a legislative response to a pressing need, welcomed by many households and businesses that saw a surge in consumption during the colder months.

How About the 2025 Amount?

The trend reversed abruptly in 2025. The payment was set at exactly $1,000, the lowest in years, following the approval of the House Bill 53, a decision that was purely budgetary: faced with less robust oil revenues and other spending priorities, the Legislature opted for a reduced dividend.

The total $685 million distributed starting in October 2025 represented a difficult compromise, generating public frustration but also a necessary debate about the model’s sustainability. Some residents still received supplemental payments from this round in January 2026, a reminder of the program’s logistical complexity.