The Social Security Administration (SSA) plans to implement the final increase to the Full Retirement Age in 2026. This change will determine when people born in 1960 or later will be able to access their full retirement benefits. The modification is part of a series of landmark legislative amendments that have progressively reshaped the pension system.

The full retirement age (FRA) is determined by the individual’s year of birth. Monthly benefits are calculated based on the number of years worked, and the income earned during that period. While individuals can choose to begin claiming benefits at age 62, this decision results in a permanent reduction in their monthly pension amount.

Avoid a 30% Reduction in Your Social Security Benefits

Those who decide to claim their benefits before reaching full retirement age see their income permanently reduced. The Social Security Administration specifies on its official website: “We use it (Full Retirement Age) to determine some of our benefit rules.” The agency also clarifies that, regardless of the full retirement age, the benefit amount increases for each month the application is delayed, up to age 70.

The increase scheduled for 2026 will set the Full Retirement Age at 67 years old for all beneficiaries born in 1960 or later. This adjustment represents the culmination of a gradual process of increases that has taken place over several years. Previously, the full retirement age had been increasing in two-month increments annually.

People born in 1960 will be the first cohorts to directly experience this change. For this group, eligibility to receive the full benefit will be activated in 2027, not 2026, when they turn 67. This transition initially affects the younger segments of the baby boom generation, specifically those born between 1960 and 1964.

Following that, the impact will extend to members of Generation X, comprised of individuals born between 1965 and 1980. The change in the age of access to full benefits redefines financial planning and career prospects for these demographic groups.

Are You Prepared for the Social Security Change in 2026?

The option to request reduced benefits starting at age 62 remains available to taxpayers. Those who choose this alternative accept a permanent decrease in their monthly payments, which can reach up to 30%. This financial decision has long-term consequences for economic stability during retirement.

Conversely, applicants who postpone receiving their checks beyond their full retirement age receive a progressive increase in the amount. This increase accumulates until the beneficiary reaches 70 years of age. The decision on when to begin receiving payments depends on an individual assessment of personal circumstances, health, and employment status.

When Will I Get My December Retirement Payment?

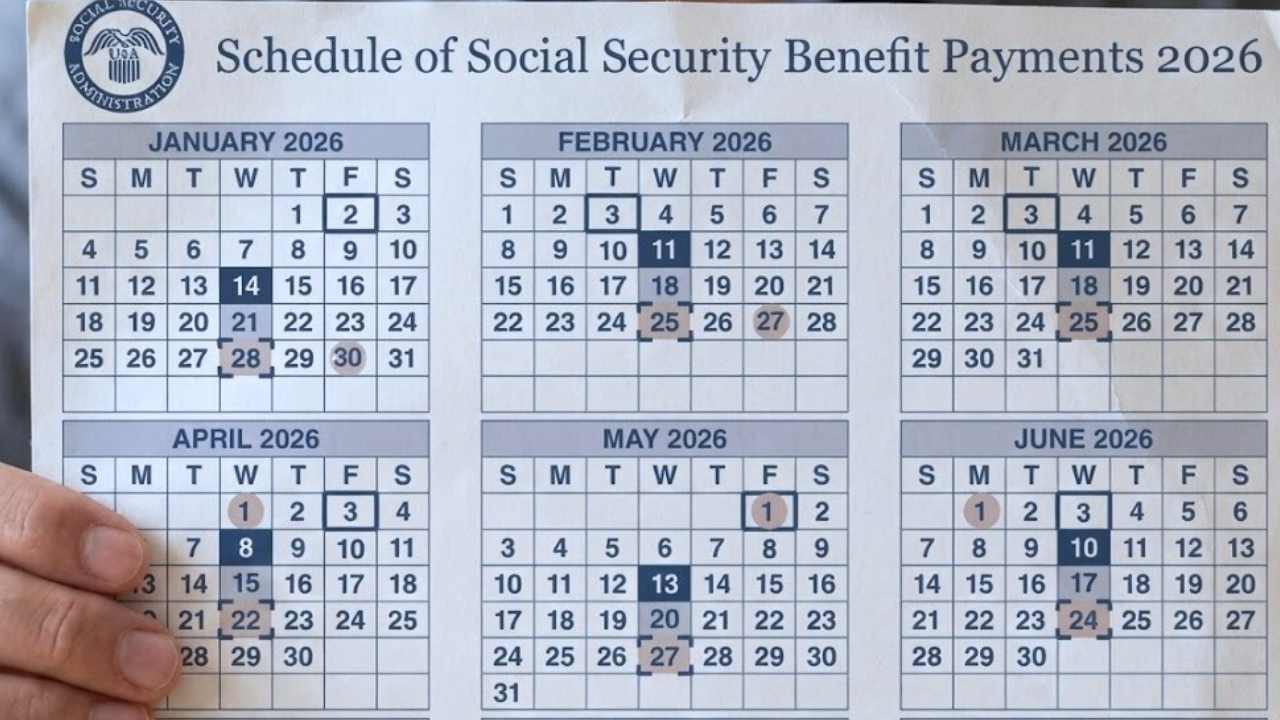

The Social Security payment schedule maintains its usual distribution based on the beneficiary’s date of birth. For regular December payments, the issuance dates are Wednesdays the 10th, 17th, and 24th, corresponding to birthdate ranges of the 1st-10th, 11th-20th, and 21st-31st, respectively. Those who began receiving benefits before May 1997 receive their payments on Wednesday, December 3rd.

Those receiving Supplemental Security Income payments will receive their December payments on a separate date, set for Monday, December 1. This staggered payment schedule allows for separate administrative management of the different assistance programs.