If you’re wondering if the Internal Revenue Service (IRS) is done sending out tax refunds as of early September 2025? That’s a super common question this time of year, especially when you’re counting on that money and it hasn’t shown up yet.

The short answer is no, they’re definitely not finished. The IRS is still processing and sending refunds for the 2024 tax year (the one we all filed in 2025). Unlike the hard April 15th deadline, there’s no single day when they flip a switch and stop.

The whole process just keeps rolling throughout the year, and honestly, even into next year for some folks. Why? Well, life happens. People file late, they file amendments, and some returns just need a little extra love and attention from the IRS employees.

Why does the IRS send tax refunds?

Think of a tax refund as basically the government giving you back the change from the taxes you overpaid during the year. This usually happens through your paycheck withholdings. You can also get a refund from certain credits (like the Earned Income Tax Credit) even if you didn’t pay a dime in.

To get that refund, you gotta file your return. The IRS started accepting them back in late January ’25. Most of us get it done by April, but a ton of people get extensions until October, and some just file late. The IRS has to handle all of it—over 140 million returns! So it’s a massive, ongoing operation.

Where’s my refund? The expected timeline

How you filed is everything. If you e-filed and used direct deposit, you were probably sipping a coffee paid for by your refund back in February or March. The IRS says most of those are done in 21 days.

But, if you mailed a paper return, that’s a whole different story. They take forever. As of right now (September ’25), they’re just getting to paper returns that showed up in August. So if you mailed yours in late summer, it’s probably just now getting looked at. You might see that refund in the next few weeks.

There are a bunch of totally normal reasons your refund might still be in the pipeline:

Extension Filers: Millions of people have until October 15th to file. Their returns are just now coming in. Amended Returns: If you filed a 1040-X to fix something, buckle up. Those can take 16 weeks minimum and they don’t even show up in the system for the first few weeks. A June amendment might just be getting processed now.

Special Credits & Reviews: Credits like the EITC are awesome, but they come with a built-in delay by law. The IRS can’t even issue those refunds until mid-February. Plus, if your return has any little error or needs verification for fraud protection, it gets pulled for a manual review, which adds weeks.

Offsets: Sometimes, your refund is used to pay off old debts, like back taxes or student loans. If that happens, the IRS will send you a letter explaining it.

How to Ccheck on your money (without losing your mind)

Please, do not call the IRS unless it’s an absolute last resort. Their phone lines are a nightmare for everyone. Your best friend is the “Where’s My Refund?” tool on the IRS website. It’s updated once every 24 hours, usually overnight. You’ll need your Social Security number, filing status, and the exact refund amount. It’ll tell you if it’s been received, approved, or sent.

For amended returns, you have to use the “Where’s My Amended Return?” tool separately. Just a heads up—checking it more than once a day won’t help; it only updates once daily.

If it’s been way past the normal time (like over 21 days for e-file or 2 months for paper) and the tool shows nothing, then you can try calling.

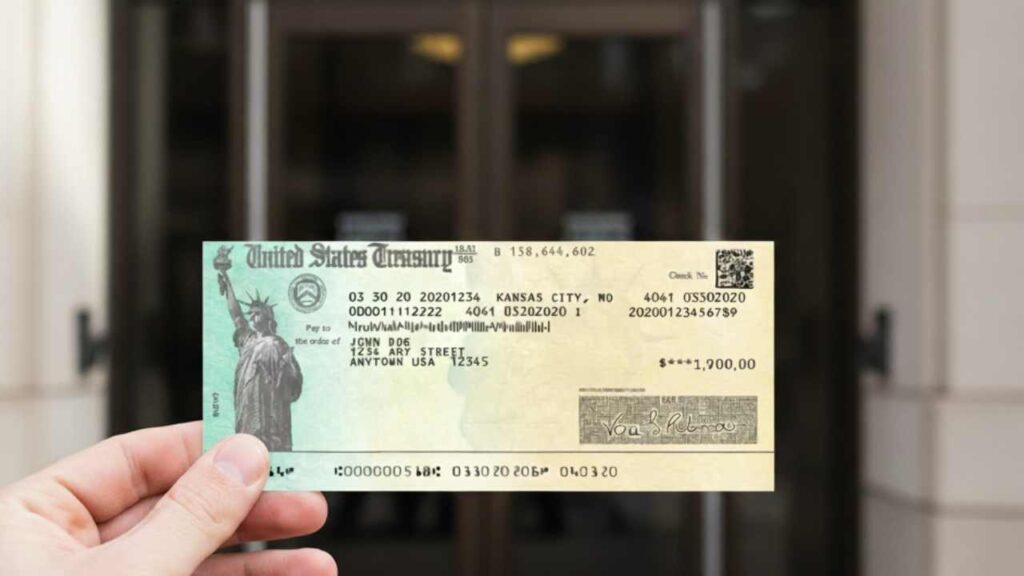

A huge change coming over IRS payments

Here’s something important if you’re still waiting: starting September 30, 2025, the IRS is done mailing paper checks. It’s part of a new rule to cut down on fraud and lost mail.

If your refund gets processed after that date, and you didn’t sign up for direct deposit, you won’t get a check. Instead, you’ll get a notice from the IRS about how to get your money electronically, probably through a direct deposit setup or maybe a debit card.

So, if you haven’t already, always choose direct deposit! It’s the fastest and safest way to get your money. The bottom line? Don’t stress yet. It’s completely normal for refunds to still be coming in September. Just use the online tools to check your status and hang tight.