The Social Security Administration (SSA) has officially set the calendar date for the 2026 cost-of-living adjustment (COLA) announcement. The news, highly anticipated by tens of millions of beneficiaries, had been thrown into chaos by shutdowns of the federal government.

This information determines the value of the monthly Social Security payments to be made starting in January next year. The initial release of the increase was scheduled for mid-October, following the usual pattern. However, a partial shutdown of the federal governmen temporarily halted activity at the Bureau of Labor Statistics (BLS).

The delay of the Social Security COLA announcement

This BLS compiles and releases the official inflation figures on which the mathematical calculation of the COLA is based. Suspension of operations threw into doubt when the announcement would be made. The SSA was waiting on the release of specific data from the BLS before it could proceed with its official calculation.

The confirmation of the new date puts an end to the administrative pause and sets a new, firm deadline for the agency to inform its final decision on benefit amounts. According to the SSA, the release of the Consumer Price Index (CPI) in September 2025 will now take place on October 24. On the same day, the SSA will announce the exact percentage of the COLA increase for 2026.

The new date to know the Social Security increases

The BLS will release the September CPI on October 24, and the SSA will use that data to calculate and announce the COLA increase on the same day, explained an agency spokesperson. This coordination between agencies guarantees that, despite the initial delay, the process is completed in a single day, offering certainty to program recipients.

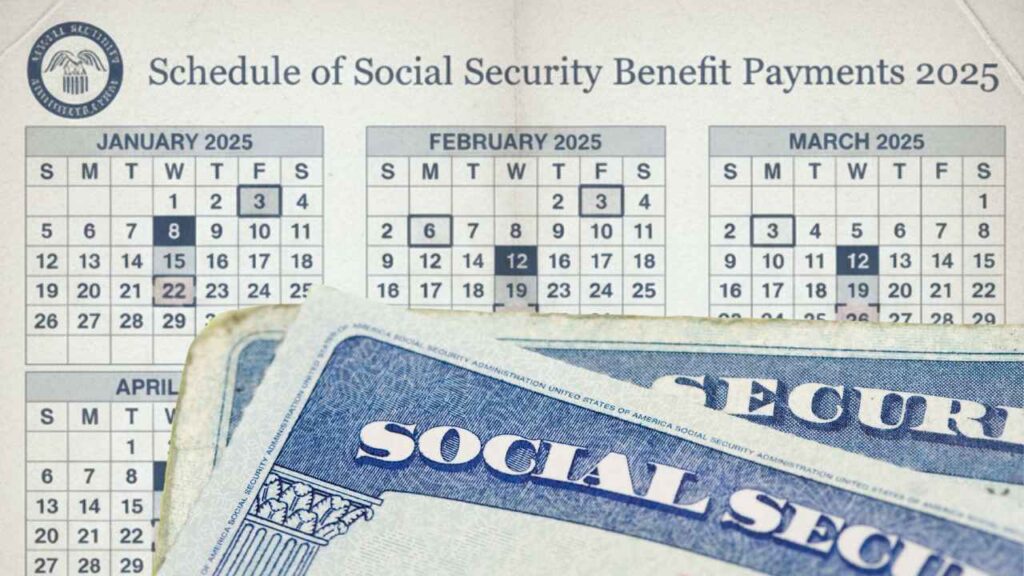

This revised schedule ensures that the technical implementation of the new percentage in SSA payment systems is completed within the established timeframe. Consequently, Social Security, disabled workers with (SSDI), and Supplemental Security Income (SSI) payments for more than 75 million individuals will reflect the adjustment beginning January 1, 2026, without additional delays.

The mechanism behind the COLA calculation

The COLA calculation is an automatic process established by law, not subject to discretion or political decisions. The formula uses data exclusively from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This index measures changes in the prices of a basket of goods and services that urban working-class households regularly purchase.

This method has been used since 1975 to make annual adjustments. The statistical objective is to prevent the erosion of the purchasing power of Social Security payments in the face of inflation. The CPI-W is considered the most appropriate indicator to reflect the spending experience of a significant portion of the beneficiary population.

The process compares the average CPI-W for the third quarter of the current year (July, August, and September) with the average for the same period the previous year. The percentage change between the two averages determines the COLA value for the following year. If there is no increase, the benefit remains unchanged.

COLA 2025 projections and scope of adjustment

According to projections from the Senior Citizens League (TSCL), a nonprofit advocacy organization, the 2026 COLA increase could be around 2.7%. These estimates are based on inflation trends observed in previous months, although the final figure depends exclusively on official figures for the third quarter.

“With the announcement so close, many retirees are anxious. While a higher COLA would be positive, many feel the adjustment doesn’t fully reflect the true price increases they face,” said Shannon Benton, the organization’s executive director.

The official percentage, once announced, will be applied uniformly to all programs administered by the SSA. The list of programs that will receive the adjustment includes retirement benefits for retired workers, spousal benefits, and survivor benefits for family members of a deceased worker.