For many of our retirees, the long-awaited October income is already on its way. Yes, this week, specifically the second Wednesday of the month, which falls on the 8th in 2025, is when the Social Security payment will materialize for a significant group of beneficiaries.

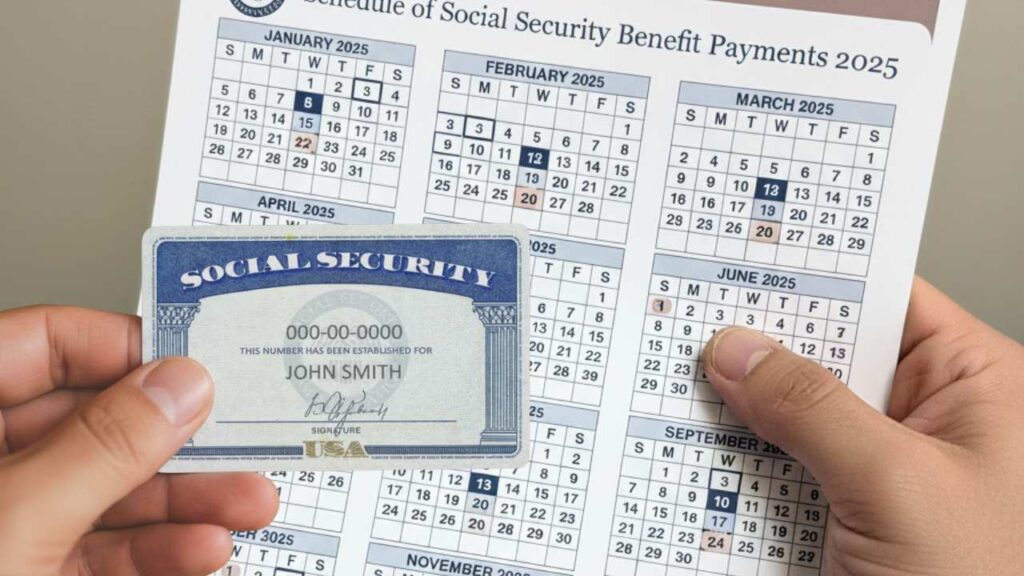

As usual, the Social Security Administration (SSA) has a very specific schedule to organize disbursements throughout the month, avoiding crowding and ensuring that everyone receives their money on the date corresponding to their date of birth.

How the Social Security payments are distributed in October

Following the aforementioned criteria, here are the upcoming payments for the retirees and surviving beneficiaries (benefits claimed after May 1997):

- Wednesday, October 8th is the turn for people born between the 1st and 10th of any month.

- A week later, on Wednesday, October 15th, it’s the turn of those whose birthdays are between the 11th and the 20th.

- And finally, on Wednesday, October 22nd, those born between the 21st and the 31st close the month.

Those who claimed benefits before May 1997 receive their benefits on October 3rd, following the criteria of disbursements every third day

Thinking about claiming retirement? Your age changes it all

Now, let’s talk about a topic that generates no small amount of confusion and is vital for those planning to retire: how age affects their payment. The idea is simple, but concrete figures help make one of the most important financial decisions in life.

Retiring at 62 isn’t the same as retiring at 70, and the monthly difference in your bank account is huge. Everything revolves around your “full retirement age,” which for most people is around 67. If you retire at that age, you can expect to receive 100 percent of your calculated benefit.

By 2025, the maximum payment for those retiring at 67 is estimated to be around $4,018 per month. Keep in mind, however, that this is a maximum amount, which only those who have contributed at very high salaries for practically their entire working life can reach.

What if I claim retirement benefits before?

But life isn’t perfect, and sometimes circumstances impose themselves, forcing early retirement. If you have no choice but to stop working at age 62, you should know that your pension will be permanently cut. In practical terms, the maximum benefit we mentioned above will suffer a significant reduction, remaining in these cases at approximately $2,831 per month.

It’s a considerable reduction, no doubt, but for many people, that immediate income, even if it’s less, is an unavoidable necessity. It’s compensation for having been contributing and starting to enjoy your pension several years earlier.

Waiting have a reward for retirees

On the other hand, there is the option for those who can and choose to stay in the labor market beyond their prime. Patience, in this case, has a very sweet financial reward. For every year you delay your retirement after age 67, until you reach 70, your monthly benefit increases thanks to what are called “deferral credits.”

This means that a retiree who has waited until age 70 to claim their pension could receive a monthly check of up to $5,108. That’s almost double what they would have received if they had done so at age 62, a difference that, over the years, amounts to tens of thousands of dollars.

In the end, the decision of when to retire is a complicated balancing act between health, personal financial situation, life expectancy, and, of course, the desire to simply enjoy a well-deserved rest.